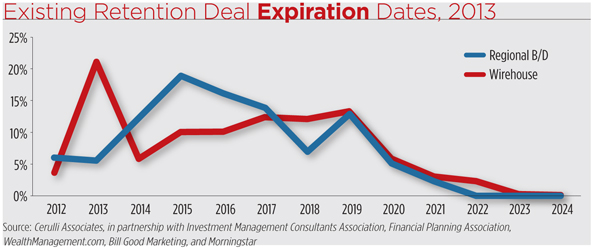

This year was arguably the best time to snag free-agent advisors from the wirehouses, with 21 percent of the big four firms’ retention packages expiring, according to data compiled by Cerulli Associates in IMCA’s quarterly research report.

Current retention packages (which consist of bonuses typically in the form of forgivable loans with upfront and back-end payout over a specified number of years) are spread out over the next 10 years. And while each year brings a new class of expired deals, 2013 was by far the year for the largest number of deals.

When packages expire, advisors are free to move to other firms—something recruiters look for when predicting movement trends. “Recruiting efforts have the option of choosing to focus on free-agent advisors whose packages have expired or to offer sufficient upfront cash in order to buy the advisor out of the existing deal,” the report said. For firms looking to cash in on free agents, the next significant wirehouse wave, this time consisting of nearly 15 percent, will hit again in 2019.

The regional broker/dealer channel should see some movement a bit earlier, as 19 percent of firms’ retention packages there are set to expire in 2015. “Some wirehouses have indicated a preference to be more selective about offers, thus midlevel producers or those not in a growth trajectory could be more likely to move away from their providers or toward independent options,” Cerulli said.