The rich are getting richer, particularly in emerging markets, according to Boston Consulting Group’s annual report on the state of global wealth (soberly entitled, “The Battle to Regain Strength”), which it released today.

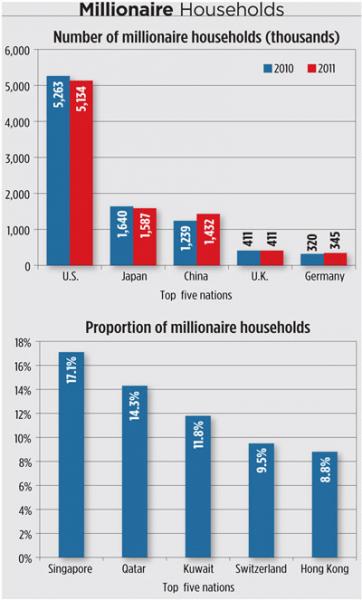

BCG says that the number of millionaire households in the world reached a record 12.6 million by the end of 2011, up by 175,000. But the developed countries actually saw a drop in millionaires of 165,000, offset by an increase of 340,000 in so-called “new world” nations such as China.

The United States still has more millionaire households—5.13 million, or 4.3 percent of the nation’s households—than anywhere else in the world, but the numbers are declining. Part of that can be attributed to volatile markets that whipsawed portfolios in 2011 as a result of the near default on U.S. debt and the downgrade of the nation’s credit rating, coupled with various overseas crises.

But the decline in portfolio values isn’t the only reason for the slip in American millionaires. Monish Kumar, a BCG senior partner, observes that demographics is playing a role. As a growing number of households enter the retirement years, they start drawing down on the portfolios they’ve built over the years.

“The reason you build a nest egg is to bring it down,” Kumar says. Demographics also plays a role in reverse for developing countries. Growing populations mean more entrepreneurs that can generate new wealth.

The larger picture of global wealth also was a study in contrasts between older developed economies and new world economies in Latin America, Eastern Europe, Middle East and Africa, and the Asia-Pacific region excluding Japan.

Global wealth last year grew by just 1.9 percent to $122.8 trillion, but the developed economies shrunk by 1 percent while the new world economies grew by 10 percent. Growth in gross domestic product in some parts of the world helped offset drops in equity performance.

North America, which had the largest regional share of global wealth, saw it slip from $38.3 trillion in 2010 to $38 trillion last year. Bruce Holley, BCG senior partner, described the U.S. wealth picture as “two steps forward, one step back” as the improvements seen in 2010 were undone by last year’s trouble.

BCG scaled back its expectations for future growth amid continued euro debt problems and slowing economies. It sees a compound annual growth rate of 4.2 percent for global wealth by 2016, to $151 trillion.

But regional variations abound. The report says that private wealth in India and China will grow at a compound annual rate of 19 percent and 15 percent respectively between the end of 2011 through 2016.

Some local and regional financial institutions in Asia-Pacific region excluding Japan are starting to compete more aggressively with international banks and are stealing greater market share, said BCG Partner Vish Jain, who follows the region.

Investors in the region prefer safety and security in their portfolios. Cash and deposits (excluding money market funds) make up more than 50 percent of wealth in this area, compared to a little more than 27 percent in North America. Jain said the nations in this region are “incredibly different,” however, and in five years the markets will be big enough to merit separate analysis.

Wealth managers across the world struggled to raise revenues and assets under management last year, although some cost reduction helped boost the bottom line. Indeed, global AUM was virtually flat last year, compared to 10.5 percent growth in 2010. (North American brokers saw AUM rise just nine-tenths of 1 percent last year.)

Pre-tax profit margins of 22 basis points was down from 23 bps a year earlier. “We’re still talking about a good business,” said BCG Principal Anna Zakrzewski. “Nevertheless, it still continues to be under pressure.”