On the surface, it appeared to reflect the dictum that on Wall Street the best FAs get better and the lowliest FAs fall behind...and pay the consequences.

The theme of the declining wirehouse industry is a narrative that never seems to go out of style. (Regulators are hopped up on Dodd-Frank! Clients sickened by bad bank headlines are heading for the doors! Independents are eating into market share!) So when Cerulli Associates last month released its annual data on the state of the broader financial advisor industry—from the big brokerages to the independents and registered investment advisors—wirehouse brokers were probably relieved at the news that their corner wasn’t getting the worst of it for a change.

The headlines in the media noted that advisor headcount was down 2.3 percent overall in 2011. But it was the independent broker/dealer market that accounted for the biggest hit in the numbers—down 10.7 percent from 2010 when including dually registered advisors (defined as registered with both FINRA and the SEC. In calculating dual registrants, Cerulli includes only advisors whose RIA registration is separate from the b/d.) The decline in IBD advisors was an even more daunting 13.9 percent when you exclude dual registrants. Industry observers said that low-performing brokers were getting squeezed out of the business—average assets under management among the departed were a meager $8 million, Cerulli said.

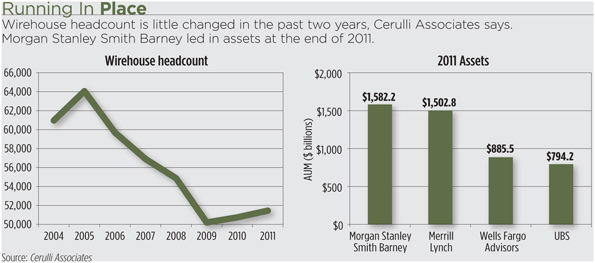

On the surface, it appeared to reflect the dictum that on Wall Street the best get better and the lowliest fall behind. Indeed, the census of advisors in the four wirehouses actually rose last year, albeit a modest 1.4 percent, to 51,450. It followed four years of declines starting in 2005. Has the slide finally bottomed out?

Alas, things are far from rosy in the wirehouse world. AUM last year reached $4.76 trillion, down a hair from 2010 and well short of the $5.22 trillion mark in 2007. And the growth of headcount in the wirehouses may reflect defections of top brokers who are replaced by younger people with far smaller books of business. Earlier this year, REP. noted that Merrill Lynch had told the SEC that it was concerned over its ability to retain advisors with wealthy clients.

And Cerulli’s crystal ball still foresees trouble. The wirehouses are still the biggest players on the block, with 41.1 percent of asset market share last year, but Cerulli says that will drop to 34.2 percent by the end of 2014. Regional b/ds and RIAs will claim some of those assets; the former’s share will grow to 19.3 percent (from 15.8 percent last year), while the latter will reach 14.4 percent (from 12.2 percent).

Cerulli Senior Analyst Tyler Cloherty says the Big Four still have the biggest checkbooks, and their willingness to pay retention bonuses to top advisors is likely to continue. Indeed, REP. reported in March that Merrill Lynch had begun offering nine-year deals to advisors that could amount to 330 percent of production, provided that the advisors could reach all the mandatory asset and growth hurdles. Such deals come with a price, Cloherty says; how do wirehouses generate organic asset growth? “It doesn’t seem to be coming from the top-end reps because they seem to be trading heads, and those guys are getting older and older,” Cloherty says. “And they’re hiring new people, but trainees don’t manage $100 million at the gate.”

One thing is clear: Advisors who leave wirehouses aren’t breaking down the door to full independence. Of experienced advisors who left the channel last year, 44.4 percent went to IBDs, according to Cerulli projections. No doubt a good number were pushed out by higher production requirements set by their former employers. Meanwhile, another 36.9 percent went to other wirehouses. Just 2.1 percent went to RIAs, either starting their own practice or joining an existing one. In spite of the broad range of support services for advisors who ponder independence, running one’s own business is not to everyone’s liking. “I think they’re just very used to a high level of support,” Cloherty says.