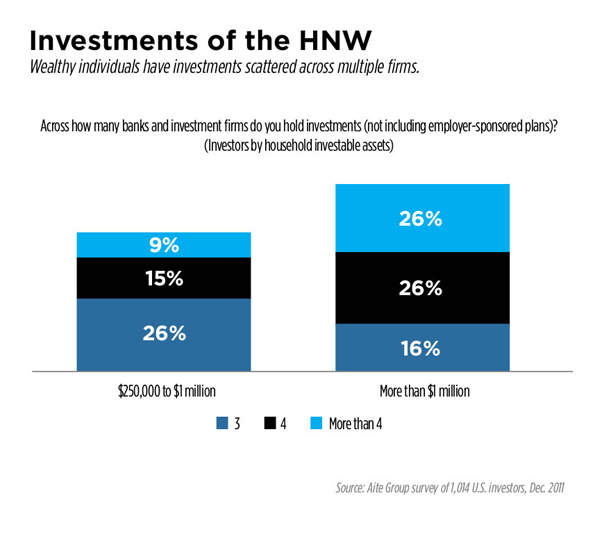

When it comes to their money, high-net-worth individuals don’t want all their eggs in one basket; in fact, half of wealthy investors with more than $1 million in assets spread their wealth across four or more firms, according to research by Aite Group. To win a larger share of HNW clients’ wallets, firms need to invest more in data management and analytics technology to improve the client experience, Aite says.

Some of the largest firms are making the right moves, focusing more on knowing the client holistically and taking them through the discovery process.

“This kind of stuff needs to be automated,” said Sophie Schmitt, senior analyst in wealth management at Aite. “It’s really hard to have a really in-depth conversation with clients and to keep up with all of their goals and needs on an ongoing basis without the right tools and systems and analytics to help that advisor along.”

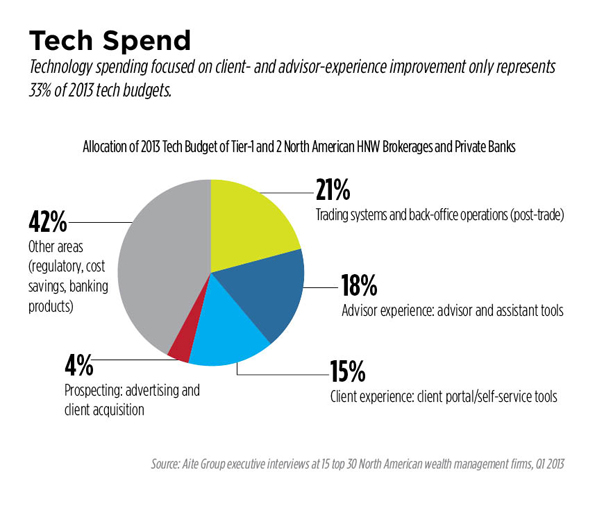

Schmitt’s analysis, based on executive interviews across 15 of the top 30 wealth management firms and on a survey of 400 advisors, found that reducing costs and meeting regulatory requirements consumed a larger share of firms’ 2013 technology budgets. Meanwhile, spending on client- and advisor-experience technologies, including client portals, mobile deployments, financial planning, data aggregation and customer relationship management, accounted for only 33 percent of 2013 budgets.

“[Firms have] left the client experience up to the advisor so much that home offices really have no control in some ways,” Schmitt said. “They can train advisors all they want but at the end of the day, there’s not a lot of oversight on exactly what advisors are doing with their client.”

And for advisors to win more wallet share, they need to keep in touch with their clients. Aite found that the top-performing practices are those that contact their clients proactively; firms say that best practice is for advisors to have 18 touch points a year with their clients. Advisors need the tools to help them to keep on top of clients and help them with what to say at those touch points, Schmitt said.

Some firms are doing innovative things in the areas of client- and advisor-facing technology. Schmitt points to Merrill Lynch’s new risk assessment tool, to give advisors insights into how they handle investment risk. Merrill is working with behavioral economists to get advisors talking less about technicalities with their clients and more about their basic financial situation—more akin to a therapist than an investment manager.

Firms are also partnering with complementary firms where they don’t have expertise, she added. Morgan Stanley recent partnered with PinnacleCare to provide health advisory services to the firm’s high-net-worth clients at a discount.

It’s one thing to actually have the technology in place, but it’s another thing to actually get advisors to use it. Peer-to-peer sharing is one way firms are trying to motivate advisors, so they can access the collective intelligence when advising their clients. Morgan Stanley is rolling out an “Insights” tool that will allow advisors to research securities that other FAs have purchased for similar types of clients.

But a lot of the technology that firms are using is still basic; they’re still talking about basic data aggregation and getting a 360-degree view of the client.

“Firms that can get beyond that and can actually get a consolidated data store, where they can query a 360-view of their client and move beyond to the more interesting stuff of, ‘How do you analyze that data? How do you deliver insights to advisors? How do you create a way for advisors to access that data to make useful decisions?’ I see those firms being in the lead.”