Stocks have been moving higher lately, seemingly suggesting that growth is improving; yet at the same time bond yields have been moving lower, implying growth prospects are deteriorating. The big debate between which of these two multi-trillion dollar markets is right has been raging among investors. But the truth is that there is no debate here—at least not yet.

Over the past 90 trading days ending Friday, May 30, the S&P 500 Index was up 4.3% while 10-year Treasury bond yields were down 35 basis points (bps)—a basis point is one-hundredth of a percentage point, so 50 bps is half a percentage point. While stock prices and bond yields have generally moved up and down together, with the exception of last summer’s “taper tantrum” that led to a spike in bond yields, modest moves in opposite directions have not been uncommon. In fact, the recent direction and pace of change in bond yields and the stock market is not unusual or inconsistent with the environment of the past five years.

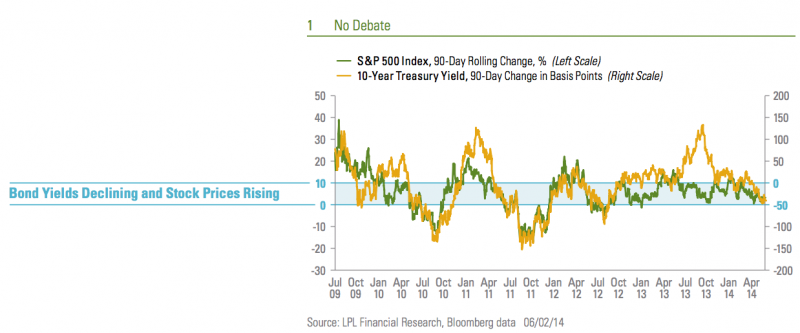

- Over the five years since the recession ended in June 2009, modest declines in bond yields in the range of 0-50 bps commonly occurred along with modest gains of 0-10% for stocks [Figure 1]. The consistency with the current behavior of these markets is evident—the pace of appreciation in the S&P 500 Index has slowed this year to about 4% in concert with the modest decline in bond yields.

- Since the end of the Great Recession, the stock market has declined only when we have seen a large decline in bond yields—more than 50 bps in 90 days. Conversely, big gains in the stock market of more than 10% in a 90-day period tended to coincide with a rise in bond yields.

- Importantly, at no time was the bond market “smarter” than the stock market—or the reverse. At no time did one market lead the other up or down. They have moved together—usually bottoming on the same day and peaking at similar times. The idea that the bond market is reacting to something the stock market has not yet noticed—but will eventually react to negatively—disagrees with the evidence of the past five years.

There are plenty of reasons why bond yields may have moved lower recently driving gains for bond investors; a few of them include (see recent Bond Market Perspectives: Slim Pickings [5/13/14] for more insights):

- Money flowing into the U.S. bond market from Europe because yields in the Eurozone have declined as growth has slowed, the risk of deflation has re-emerged, and the European Central Bank (ECB) is likely to lower rates again.

- Unusual declines in the Chinese currency suggesting Chinese investors are aggressively buying U.S. dollar-denominated assets such as bonds.

- Reassurances from the Federal Reserve (Fed) that rates may stay lower for longer than had been expected.

At the same time, the stock market has been rising for several reasons, including:

- More stimulus likely coming from central banks around the world in June, including the ECB and Bank of Japan.

- The Fed’s reassurances that any rate hikes will be dependent upon a much stronger economy along with higher inflation.

- U.S. economic and profit growth showing signs of improvement.

- Money coming into the stock market from corporations doing buybacks and from individual investors reallocating their portfolios and putting cash to work.

Of course, some of the reasons on both lists are the same, further supporting the point that there is no debate in the markets. Moves in both markets have been consistent with a favorable environment for investors and a potential for modest returns. However, were they to keep moving in these divergent directions at an accelerated pace—stocks rising over 10% in the next 90 days while bond yields fell, or bond yields falling more than 50 bps while stocks rose—it would likely be a debate that would lead to an unfavorable outcome for one of the markets.

Jeffrey Kleintop is Chief Market Strategist and Executive Vice President at LPL Financial. In this role, he leads the development and articulation of LPL Financial Research market and investment strategies.