I can’t believe nobody’s done this before. I mean putting out a gold/silver ratio ETF. During the recent precious metals swoon, it would have been a real money maker. While gold and silver tumbled from their lofty heights over the past 3½ years, the ratio’s risen to near historic levels.

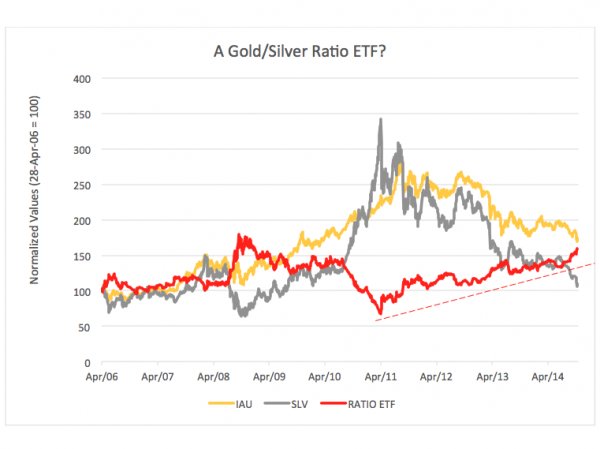

Well, truth be told, gold’s been falling; silver’s been doing the tumbling. Since April 28, 2011, the fifth anniversary of its launch, the iShares Silver Trust (NYSE Arca: SLV) has swooned 68 percent. Meantime, its companion iShares Gold Trust (NYSE Arca: IAU) has lost 25 percent of its value. If iShares sponsor BlackRock had issued a fund that tracked the price ratio of IAU to SLV, it would have risen 135 percent over that time. Just take a look at the chart.

Not a bad trade, right? Of course, you would have had to know that the gold/silver ratio was hitting a secular low (around 30-to-1) in April 2011. That might have been easier to discern if you knew the ratio’s average through most of the 20th and 21st centuries has been 47-to-1.

And now? Now it’s 74-to-1. So high is the ratio presently that precious metals pundits and dealers are recommending gold sales as a means to finance silver purchases in anticipation of a reversion to the ratio’s more historic mean. You can certainly see the mercantile interest a dealer has in making such a recommendation.

Until such time as BlackRock or another ETF manufacturer debuts a ratio product, there are a couple of ways to play this mean reversion game. Silver futures could be bought against the short sale of gold contracts, for example. Futures trading isn’t suitable for every investor, though. An alternative strategy can be executed in a securities account with option authorization: the purchase of long-term (LEAPS, or Long-Term Equity AnticiPation Securities) calls on SLV together with the purchase of IAU LEAPS puts.

A package of slightly out-of-the-money options, expiring in January 2016, could be purchased for a little more than $500 now. The trade offers leverage (each contract controls 100 ETF shares) and limited risk. Coin dealers are sure to hate that.

Brad Zigler is former head of marketing and research for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.