The speculators are back. Gold speculators, I mean.

Their footprints can found in the market for gold mining stocks. I should say the markets for gold mining shares because punters can opt for producers—companies that have actually found metal—or juniors, otherwise known as exploration and development (E&D) companies, which are looking for the shiny stuff.

Think of producers as the blue chips of the gold trade and juniors as venture capital. The paybacks for each are commensurate with their risk. There’s actually cash flow—and hopefully, profit—in the everyday business of the producers. Investors in juniors are betting on the come, hoping for a strike that turns their companies into producers or buyouts by other firms.

The VanEck Vectors Gold Miners ETF (NYSE Arca: GDX) is a benchmark portfolio containing 49 producers including Barrick Gold Corp. (NYSE: ABX), Newmont Mining Corp. (NYSE: NEM) and Goldcorp Inc. (NYSE: GG). A yardstick for measuring the performance of E&D companies and smaller producers is the VanEck Junior Gold Miners ETF (NYSE Arca: GDXJ), a package of 47 global names. Putting GDXJ’s price in ratio to GDX’s gives you an indication of investors’ ongoing appetite for risk. A rise in the relative value of the junior portfolio signals increasing speculative fervor while a falling ratio suggests risk aversion.

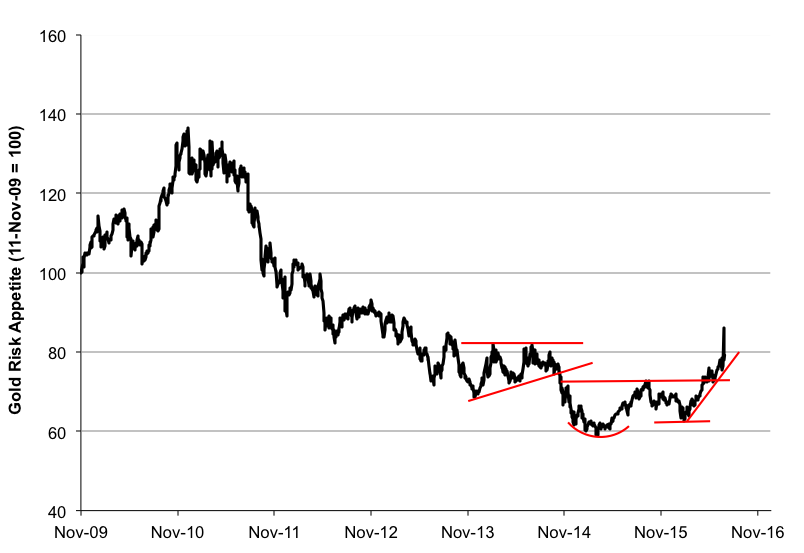

Look at the ratio charted below. See last week’s speculative spike? It’s vertical. Straight-up trajectories like that aren’t sustainable. Still, a base has been built that signals further sharpening of investors’ risk appetite.

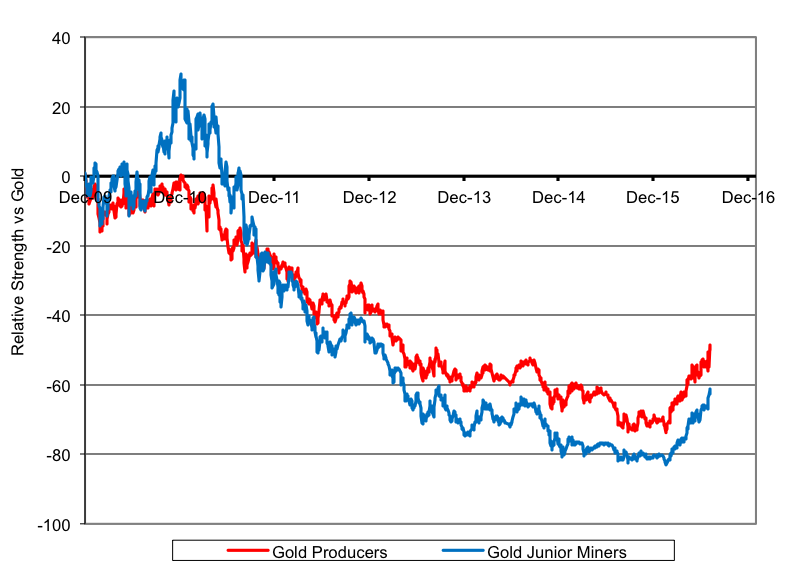

A more telling picture of the market’s speculative state can be found in a chart of the two miners portfolios’ relative strength. See the crescendo in December 2010? Back then, as bullion ratcheted upward, juniors were bid up way ahead of producers. Eight months later, as gold peaked, miners’ fortunes were reversed. Juniors weakened more than producers.

The spread between the miners’ strength gauges is narrowing now, squeezed by quickening interest in E&D companies. When—and if —juniors overtake producers, it’ll be time to start looking for the exits from the gold trade. To start looking. Don’t be too anxious to push your way out the door, or to sell gold short. Given the experience in 2010-2011, it’s best to keep in mind J.M. Keynes’ axiom: “The market can stay irrational longer than you can stay solvent.”

For now, the technical picture for gold—and its ETF proxies—remains positive. For example, the SPDR Gold Shares Trust (NYSE Arca: GLD), now churning at the $130 level, has the impetus to break out to $145. Once there—again, if there—an assault on the $160 level can be contemplated.