Have you ever wondered why that little voice in the back of your mind is called a “nagging doubt?” The word “nagging” is defined, inter alia, as persistent anxiety or annoyance. When I see the trail traced by high-yield credit spreads, I can hear that small nudge.

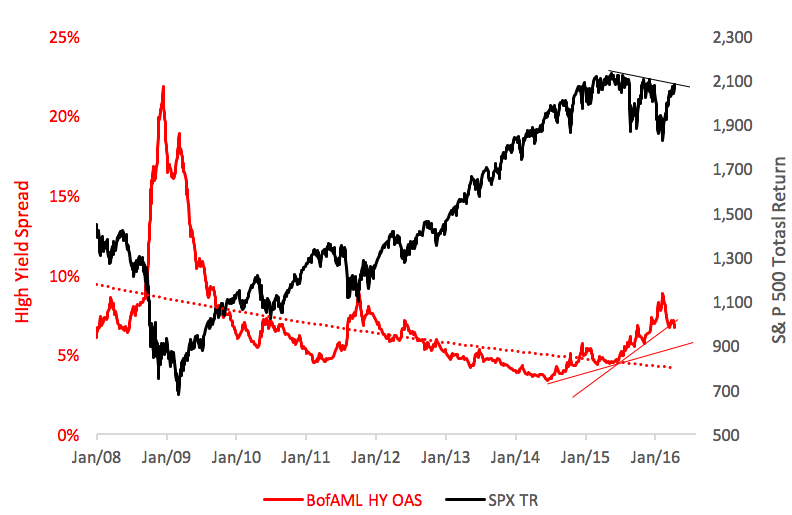

Here’s a picture of the Bank of America Merrill Lynch High Yield Option Adjusted Spread (OAS, in red) versus the total return version of the S&P 500 Composite:

The spread represents the yield differential between high-yield, or “junk,” bonds and Treasury securities. The first thing you’ll note is the inverse relationship between the yield spread and the blue chip index. Generally, when spreads widen, the stock market swoons; narrowing spreads correspond to upswells in the equity market.

That should make sense. Spreads are, after all, predictors of economic activity. Yields reflect risk. When risk is high, yields—and yield spreads—spike upward. When credit spreads are thin, perceived risk is low, bespeaking confidence in the economy.

High-yield spreads turned upward in mid-2014, presaging by a year the breakdown in the S&P 500. Now, as equities rebound, we’re seeing the spread decline.

We should feel good about this, right?

Well, yes, but you have to keep in mind that credit spreads, like any market, are impacted by supply and demand.

In the current low-yield environment, institutional investors—pensions and insurance companies, in particular—tend to buy riskier assets (read, reach for yield) in order to earn the return necessary to ensure future payments to beneficiaries.

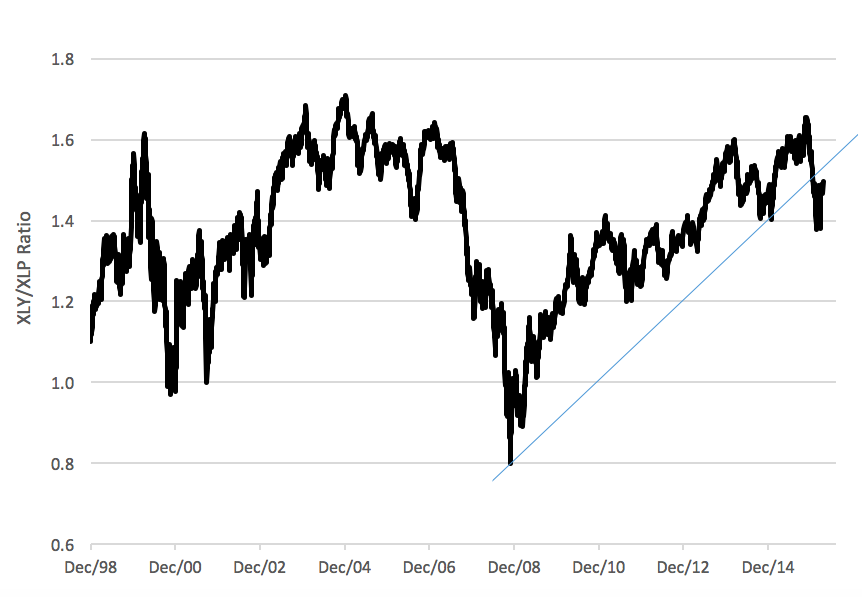

That’s my nagging doubt, magnified by the spread between the Consumer Discretionary Select Sector SPDR ETF (NYSE Arca: XLY) and the Consumer Staples Select Sector SPDR ETF (NYSE Arca: XLP) as you can see in the chart below.

Credit spreads reflect, by and large, institutional expectations for the economy. The XLY/XLP ratio, on the other hand, reflects broader investor beliefs. Discretionary spending, epitomized in XLY’s pricing, tends to expand when consumers are confident of the economy’s direction. XLP, in contrast, fares better when investors feel defensive.

The nagging question is this: Whose outlook do you believe is correct? Institutions or individuals?

Brad Zigler is REP./WealthManagement's Alternative Investments Editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.