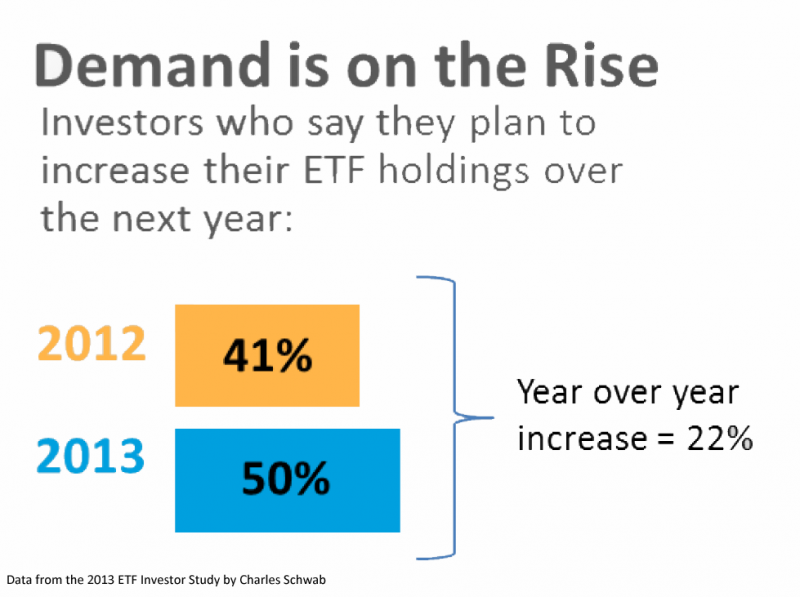

Despite pulling a record number of assets from ETFs in August, half of investors plan to increase their ETF exposure over the next year, and 46 percent of them want to learn more about ETFs from a financial professional, a new survey from Charles Schwab shows.

The ETF industry suffered $20.4 billion in outflows in August, the worst month of flows for ETFs on record, according to Morningstar. That compared to inflows of $39.5 billion in July.

Yet 9 percent of the over 1,000 investors surveyed in August by Schwab said they have more than half of their portfolio in ETFs, up from just 4 percent in 2012. Meanwhile over 56 percent have at least 10 percent of their assets in ETFs, the report says.

"We're seeing less discussion of 'if' and more about 'how' investors will buy and use ETFs,” said Beth Flynn, vice president of ETF platform management at Charles Schwab.

"We're seeing less discussion of 'if' and more about 'how' investors will buy and use ETFs,” said Beth Flynn, vice president of ETF platform management at Charles Schwab.

For those not investing in ETFs, a lack of understanding is the top barrier. Approximately 31 percent of investors are not using ETFs because they don’t understand them well enough, while 16 percent stay away because they don’t know how to build a diversified portfolio with them.

But the survey shows that most investors are not daunted. Almost 45 percent consider themselves novices when it comes to ETFs, but they are learning; two in five said they know more now than 12 months ago. “We're seeing an upward shift in sophistication among ETF investors, and a hunger to learn more," Flynn said.

Advisors are a key bridge in this transition. Almost half say they prefer to learn about ETFs from an advisor. The Internet is another big draw, with 66 percent of investors interested in learning from a website that consolidates ETF-specific educational content from a wide range of expert sources.

Once investors understand the basics of ETFS, fees are another major concern. Almost all investors (94 percent) believe understanding the total cost of ETFs is critical. More than 70 percent say having clarity on redemption fees and other hidden fees is extremely important. And 45 percent of investors want to trade ETFs commission-free, without strings attached.

Among the 94 percent of investors who know they have at least 1 percent of their portfolio in ETFs, the majority invests in sector funds. About half of investors favor sector funds, followed by equities and international. And among the specialty ETFs, investors are most likely to purchase commodity ETFs, the study found.