Sixty percent of investors say they want ETFs to be made available within 401(k) plans, according to Charles Schwab’s 2014 ETF Investor Survey released today. But there are still barriers to getting ETFs into 401(k)s, and it will take time to gain traction with plan sponsors, said Heather Fischer, vice president of the ETF platform at Schwab.

“We know that plan sponsors have a lot of internal constituents that they need to get on board if they’re thinking about something like this,” Fischer said. “It’s not something that’s going to change in a day. This is turning a battleship.”

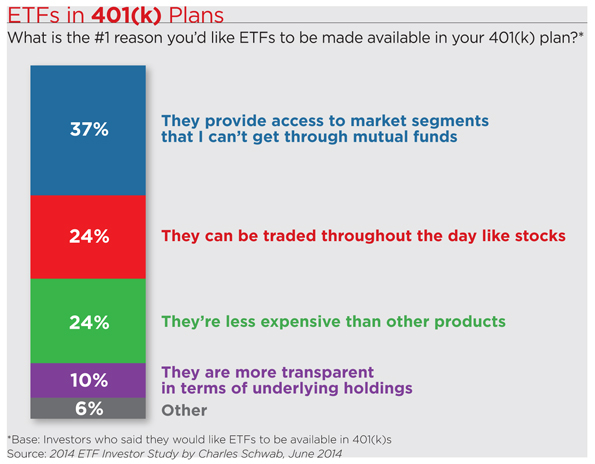

Of those who said they wanted ETFs in 401(k)s, 37 percent said the top reason was to get access to market segments that they wouldn’t otherwise have through a mutual fund. “[Investors] are looking for that expansion and that ability to invest where they want to,” Fischer added.

Investors also said they want ETFs in 401(k)s for their low cost (24 percent) and the fact that they can be traded intra-day (24 percent), according to the survey. Ten percent liked that they are more transparent in terms of their underlying holdings.

But ETFs’ ability to trade intra-day is one technological hurdle to getting them into plans, said Michael Iachini, managing director of ETF and mutual fund research at Schwab.

“401(k) plans are really set up to only have end-of-day trading with mutual funds, and ETFs of course can trade intra-day,” Iachini said.

Also, with mutual funds, you can trade a certain dollar amount, versus whole shares with the ETF structure. So if you want to put a certain dollar amount into an asset class in an ETF, you’d have to find some solution involving fractional shares.

In February, Schwab launched a 401(k) program that would allow investors to put 100 percent of their portfolio into ETFs.

In February, Schwab launched a 401(k) program that would allow investors to put 100 percent of their portfolio into ETFs.

The study, conducted Koski Research for Schwab, was an online survey of more than 1,000 investors with at least $25,000 in investable assets who have purchased ETFs in the last two years or are considering doing so in the near term.

While it’s growing, ETFs make up 18 percent of portfolios among those who own them, Schwab found. And when asked to compare ETFs to a dinner menu, 57 percent likened them to a side dish, versus 30 percent who see them as an optional dessert and 13 percent who view them as the main entrée. Investors are not diving in with both feet, Iachini said; it’s still a fairly young industry compared to the stock market and mutual fund industry, and most of the growth in ETFs occurred after 2001.

“Investors haven’t had the opportunity to grow up with these investments,” Iachini said.

But 401(k) plans have the potential to change that, he added. Investors are more comfortable with mutual funds because they have them in their 401(k).

“If ETFs become part of that business, then I think the familiarity with ETFs will grow, and investors will say, ‘OK I know how to use these right now,’” he said.

Half of investors surveyed plan to increase the proportion of ETFs in their portfolio in the next five years.