Impact investing can be seen as a way for investors to align their investment philosophies with their personal beliefs, prioritizing investments that advance social or environmental change with the goal of generating returns.

Similarly, organics are paving the way in the food products industry as consumers have become increasingly conscientious in recent years, particularly when it comes to the products they bring into their homes. Investors’ desire to protect themselves and their families from the toxins and pesticides used in growing and preserving much of our food has led to accelerated growth in the use of naturally derived products, such that today, 84 percent of U.S. consumers buy organic food, with 45 percent doing so at least once a month.

As Americans become more aware of the environmental and health benefits of organics, there is an opportunity to protect our financial health and align our investments with our lifestyle choices by investing in the companies that are driving organic innovation and bringing natural products to the marketplace.

Demand for Organic Goods Shifts Supply

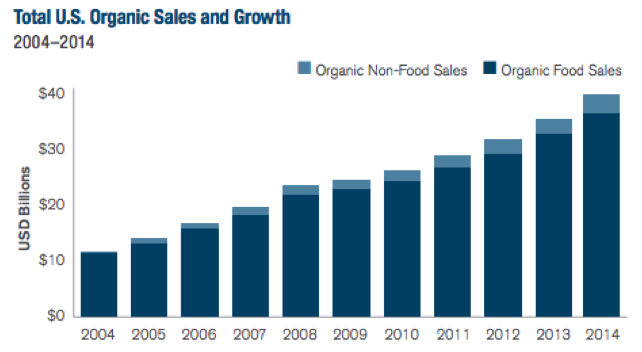

With many Americans focused on living healthier and more natural lifestyles, organic foods and products are moving into the mainstream. Sales of organic food products increased from $3.6 billion in 1997 to over $39 billion in 2014—a tenfold increase in 17 years. And the demand for organic food doesn’t end at home: three in five American consumers report that they have picked restaurants because of organic or environmentally friendly menu choices.

Nor is the demand for natural products limited to only food. The global organic personal care industry, including natural cosmetics, hair care and skin care, is expected to reach almost $16 billion in revenue by 2020. For skin care products, that represents a compounded annual growth rate of 9.8 percent from 2014 to 2020.

Investment Opportunity in Organics

As consumer wallets shift spending to organics, it’s important to understand how that will impact the companies driving the trend and may represent an investment opportunity for those who believe in their investment dollars aligning with their consumption dollars. Many of the companies poised to benefit from this trend are household names, including Whole Foods (WFM) and Hain Celestial (HAIN), makers of organic and natural food, beverage and personal care products. Other companies include WhiteWave Foods (WWAV), an acquisition target of French dairy company Danone, and emerging market companies like China Shengmu Organic Milk, which provides healthy alternatives to mainland Chinese consumers concerned about the quality and safety of the conventional dairy system in China.

Outside the U.S., companies like Royal Wessanen (WES), a Netherlands-based, multinational food company focused on organics, and L’Occitane, an international retailer of body, face and home products, are helping to meet consumer demand for natural goods. U.S. farms are also playing a role in meeting demand abroad. There are currently roughly 19,500 certified organic farming operations, with more than 3,000 farms moving to organic products, and in 2014, U.S. farms exported some $550 million in organic foods compared to $412 million just three years prior.

As consumer and investor interest in natural products continues to grow, more companies may be willing to focus on organics, expanding the marketplace and the impact these goods can have on people’s wellness and investment portfolios. Companies that advance these causes by bringing natural foods and products to the marketplace will continue to benefit, as consumers’ affinity toward these products shows no signs of waning. The bottom line: For investors seeking to bring their investments in line with their interests, the organics market poses an enticing opportunity.

Nick Cherney is a Senior Vice President and Head of Exchange Traded Products at Janus Capital Group. Janus launched the Organics ETF (ORG) in June.