(Bloomberg View) -- Janus saw the writing on the wall. And it wasn’t pretty.

Like many big asset managers, Janus Capital Group is caught on the wrong side of two powerful trends that are reshaping the financial industry.

The first is the wholesale shift by investors from active management of assets to passive investments. In the last 36 months alone, there has been a $1.5 trillion swing out of active and into passive. That has lifted the market share of passive products, such as Vanguard index funds and exchange-traded funds tied to the S&P 500, to about 30 percent of all retail assets -- up from about 20 percent five years ago.

The second, related trend is that money is moving from high-cost investments to low-cost investments. This is actually the mother of all trends: It’s the dominant force behind many investment changes in the financial industry today, including Janus’s decision to tie up with fellow asset manager Henderson Group.

This “cost migration” to low-fee products really comes to light when you isolate flows by investment vehicle. For example, looking at flows among actively managed mutual funds generally shows outflows from those that cost more than the average active fund fee of 0.69 percent . And in some cases, money is even flowing out of funds that have beaten their benchmarks -- showing that costs can be more important than performance. For example, the Fidelity Advisor Diversified International Fund (FDVIX) posted a three-year annualized return of 5 percent, handily beating the 3 percent posted by the MSCI EAFE Index. Its reward: $7 billion in outflows.

There are many similar examples of outperforming funds seeing investor withdrawals:

On the flip side, there are two fund families out of the top 20 whose active mutual funds have bucked the trend and taken in cash recently: Vanguard and Dimensional Fund Advisors. What do they have in common? Their average fund fees are 0.20 percent and 0.36 percent, respectively, which is well below the .69 percent average. And some of their funds that took in cash actually underperformed. This is at once good news and bad news for active managers. It shows that investors will still go active, but they want it cheap.

This cost migration can also be found within index funds, which are already dirt-cheap. For example, the top 10 index funds seeing outflows have an average fee of 0.45 percent, while the top 10 seeing inflows -- almost all Vanguard -- have an average fee of 0.10 percent.

Low rent seeking is especially prevalent among ETFs, where the average fee is 0.25 percent, but the 10 ETFs that took in the most money over the last three years have an average fee of just 0.11 percent.

The downward pressure on costs can also be seen in the advisory world and is starting to be seen within hedge funds, which have seen about $60 billion in outflows this year.

And it is likely to get even worse. The U.S. Department of Labor’s conflict-of-interest rule will require that advisers put client interests first in picking investment vehicles. This rule, which goes into effect in April, is the reason BlackRock gave last week for slashing its fees -- again -- on ETFs to near-free levels. BlackRock is cannibalizing its business to survive in the low-cost, post-DOL, Vanguardian future.

This accelerating shift to low costs is sure to be felt across the financial world because fees earned off of retail products produce an outsized portion of the industry’s revenue. So the ripple effects are big. And when asset managers make less money, so do the Wall Street banks they trade with, the back-office providers they use, their data vendors, PR firms, and so on.

The reason all this isn’t more obvious right now is that the bull market in stocks and bonds over the past eight years has basically offset the fee losses.

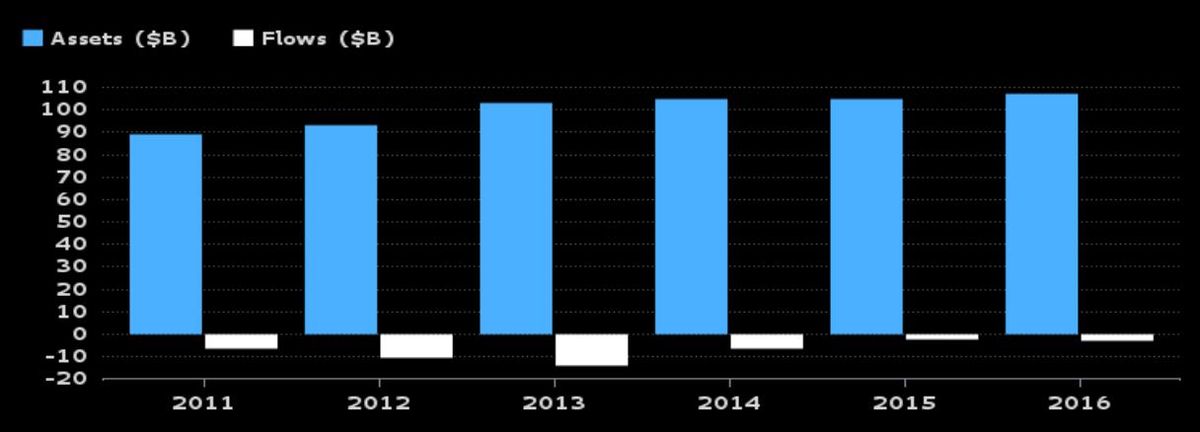

Using Janus as an example, its U.S. mutual funds -- which have an average fee of 0.81 percent -- saw approximately $40 billion in outflows over the past five years, which is nearly half of its assets. Yet, the funds’ assets increased over the same period from $87 billion to $107 billion:

It seems like magic, but it’s because the stocks and bonds in the funds’ holdings rose in value. Asset management may be one of the only businesses where customers can leave in droves and it doesn’t immediately affect the bottom line. Janus’s situation is a microcosm of the entire fund industry’s: Its revenue source is shrinking, but you can’t see it in the total asset or revenue numbers.

These kinds of market returns are unlikely to last forever. The second-longest bull market in history is getting on in years, and most predict muted returns at best going forward. This is the writing on the wall Janus must have seen. So it found a partner before it was forced to.

Don’t be surprised if others do the same.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

To contact the author of this story: Eric Balchunas at [email protected] To contact the editor responsible for this story: David Shipley at [email protected]

For more columns from Bloomberg View, visit bloomberg.com/view