In a sense, it almost resembles a parade that leads into one end of a tunnel only to have a similar parade exiting the other side of the tunnel at about the same time. As new ETFs continue to be issued across mainstream, obscure and all the categories in between, we see that over 21 percent of the more than 1,500 exchange traded products are still trying to reach a meager $10 million in assets under management. Even more striking may be the more than 180 ETPs that currently have less than $5 million in AUM.

What may be the most alarming insight within these statistics is that according to an informal industry consensus of those experts with which we interact, achieving $5 or $10 million in AUM represents significantly less than half of the necessary critical mass needed to achieve financial sustainability in the ETP business.

So the ETP Parade continues and with the recent release of the ETFG Monthly ETP Liquidation Watch, let’s take a closer look at closure side of this parade.

2013

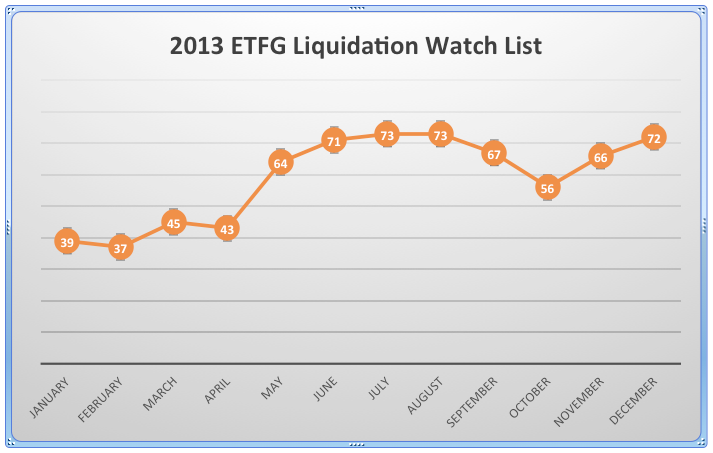

Certainly the number of names on the ETF Liquidation Watch List has even grown well beyond the growth in the number of outstanding ETP products. Last year, the size of the list almost doubled from beginning until the end of the year. At this time last year, there were only 39 names on the list. In 2013, the number of names on the monthly list averaged 59, steadily grew and reached its peak in the months of July and August with 73 in each month. While this high in the summer subsided slightly in the beginning of the fourth quarter of 2013, it regained that level at in December to close out the year with 72 names on the list.

January 2014

On the January 2014 Liquidation Watch List there are 89 ETPs, which is substantially more than the 72 ETFs that were on the December 2013 Liquidation Watch List. This by far represents the largest number of names that we have ever had on the list since it was introduced in 2012.

Interestingly, out of the approximately 1,528 ETPs in the ETP universe last month, there were 188 that had less than $5 million in assets under management, an astounding 602 that had negative performance for the training 12-month period and 1,215 that were eligible because they were issued more than two years ago.

Background

The ETFG Liquidation Watch List is not meant to predict that each month’s listings are those ETPs on the brink of closing. Rather, the list is intended to assist investors and financial professionals to simply be aware that these funds contain all three characteristics which we think would reasonably bring them under the scrutiny of their respective issuer and hopefully to the attention of any investor or advisor. These three criteria are simple and very straightforward:

·Assets Under Management – the ETP currently has AUM of less than $5 million

·Age – the ETP has been in existence more than two years

·Performance – the ETP has negative trailing 12-month performance