There’s been considerable chatter among gold aficionados about the rebound in mining stocks. What rebound? You did know that junior miners – that is, exploration and development companies— are up five percent on the year, right?

Okay, a five percent gain in a half-year may not seem impressive to you, but what has the chattering class abuzz is the fact that the juniors are now ahead of producers – the outfits that actually haul metal out of the ground. The seniors, if you will, are up only two percent year to date. Through mid-May, producers were actually doing better than the E&D companies.

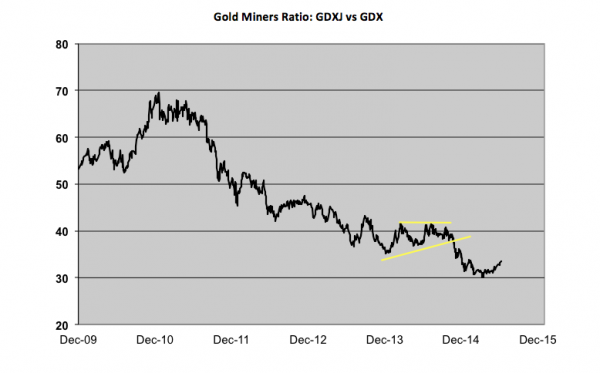

You can see this reversal of fortunes played out if you track the price ratio of the Market Vectors Junior Gold Miners ETF (NYSE Arca: GDXJ) to the Market Vectors Gold Miners ETF (NYSE Arca: GDX). GDXJ’s portfolio is comprised of 65 issues including the likes of Hecla Mining Co. (NYSE: HL) and AuRico Gold Inc. (TSE: AUQ). The GDXJ roster boasts an aggregate 12.4 price-to-earnings multiple. GDX assembles 38 stocks, including Goldcorp Inc. (TSE: GG) and Barrick Gold Corp. (TSE: ABX), with an average 28.3 P/E ratio.

You could say that the juniors are a value play but it’s more accurate to say that these stocks just appear cheap. They, in fact, could get a lot cheaper. More on that later. For now, take a gander at what’s causing the stir. See the rebound in the miners ratio?

Here’s the 4-1-1 on the ratio: it’s commonly thought to be a gauge of investor risk appetite. See the last sustained rise in the ratio back in the latter half of 2010? Then bullion shot up 16 percent as the ratio strengthened 33 percent.

But here’s the kicker: gold continued to rise long after the ratio topped out and started its five-year slide. If the ratio was an early warning klaxon, it sounded prematurely. Way prematurely. Like nine or ten months.

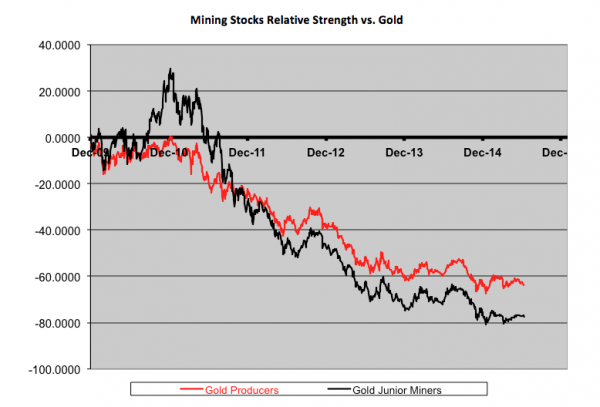

Now, if you think the cup-and-handle bottoming in the miners ratio signals a golden future, consider the stocks’ strength relative to bullion. At best, the slide has paused. Take note of the chart below.

There’s a lot more work to be done before you can say the trend has actually reversed. So relax, bullion bulls. Don’t get too excited. Yet.

Brad Zigler is REP./WealthManagement's Alternative Investments Editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.