If you own a car or buy heating oil you’re probably happier now than you were a year ago. Petroleum prices have swooned deeply over the past 12 months, no doubt boosting your household’s discretionary spending power. If you’re happy about this, independent oil refiners, and their investors, are absolutely ecstatic.

That’s because oil refiners straddle the supply chain, buying crude and “cracking” it into distillates like gasoline and diesel fuel for later sale. It’s easy to see why refiners would be happy about low input costs, but why would they be tickled about lower price prices for outputs? Because distillate prices haven’t fallen to the same degree as crude costs, that’s why. In the past year, WTI crude’s spot price has slumped more than 40 percent. Wholesale gasoline, meanwhile, dipped just 29 percent. Diesel and heating, both chemically and economically similar, have eased 39 percent.

Here’s the refiners’ deal: a benchmark operation turns three barrels of WTI into two barrels of gasoline and one barrel of diesel (or heating oil). It doesn’t take much mathematical savvy to appreciate how the so-called “crack spread” could have fattened in the past 12 months.

To really get a sense of the corporate impact of the crack spread, you need to massage it into terms understood by investors and analysts. Enter the “gross refining margin,” a metric that takes the per-barrel spread and divides it by the cost of input crude. In the past year, the GRM’s nearly doubled though it’s fallen off its early 2015 peak.

Take a look at the chart below. The GRM’s in red and, in black, is the dividend-adjusted share price of Valero Energy Corporation (NYSE: VLO). Valero, the San Antonio-based leader among U.S. independents, has been on a tear, rising 44 percent since December 2014.

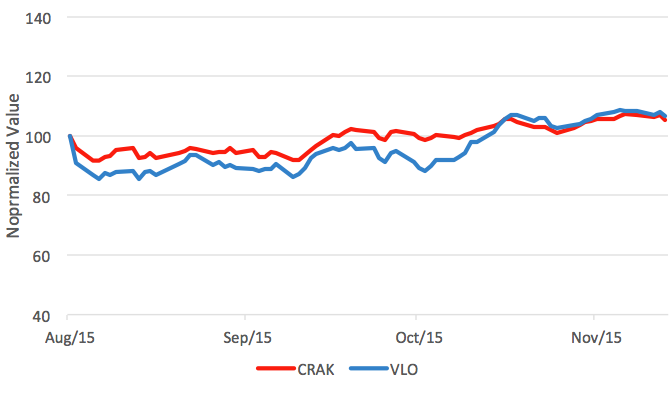

If you’re late to the oil game, you don’t have to pay up to buy into Valero. The stock’s now at the $70 level and technically destined to touch $75. A better play, if you’re hoarding dollars, may be the Van Eck Market Vectors Oil Refiners ETF (NYSE Arca: CRAK) at twenty bucks or so.

CRAK is a passive ETF that tracks the Market Vectors Global Oil Refiners Index, a modified market cap-weighted benchmark composed of the largest and most liquid companies in the global oil refining segment. Valero takes up 8 percent of CRAK’s 26-stock portfolio space.

CRAK, the only ETF exclusively tracking oil refiners, been around since August and has an 81 percent correlation to VLO. If VLO hits its target, CRAK should be dragged about 10 percent higher.

The ETF may not be a gusher, but it doesn’t figure to be a dry hole this winter.

Brad Zigler is REP./WealthManagement's Alternative Investments Editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.