Are you a gold investor? Feel like taking a flier? Need a hedge?

I ask because the floorboards under the gold market have been weakening over the past month. That's not to say gold's bullishness will wane over the long term (the metal has been, as we illustrated in our column a couple of weeks ago, in a bear market rally) but the short-term dynamics have changed.

Earlier, gold was striving to test overhead resistance. Now it’s trying to hold above support. A decisive close under $124.40 for the SPDR Gold Shares Trust (NYSE Arca: GLD) puts the months-long rebound into question. It would be, in fact, a trap door opening for a drop to the $119 level. Not a big move, mind you, but big enough.

Big enough for what? To pique the interest of punters and hedgers.

There are four inverse gold exchange-traded security products (ETPs) these traders could use to exploit a downdraft in bullion prices. Only one is a fund, the rest are notes. Three of the products were launched in 2008; the youngest debuted late in 2011.

What could we expect from these products if gold and its GLD proxy sell off to the technical price objective?

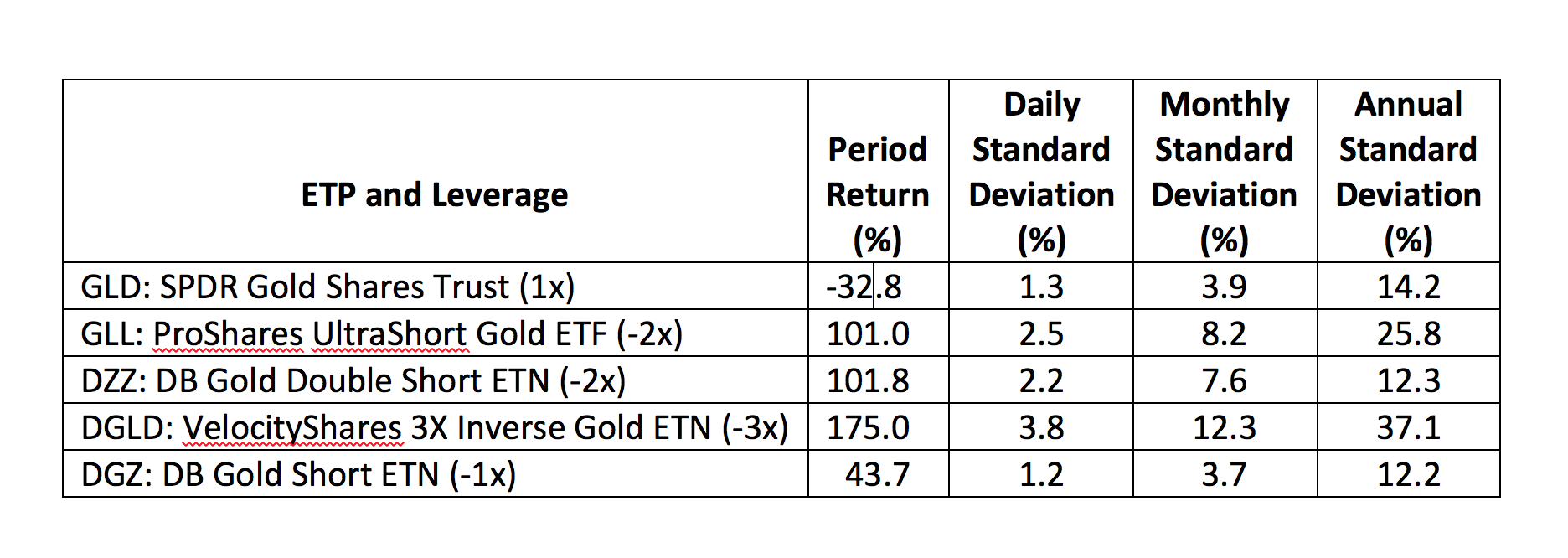

Some history would be instructive. The sharpest downdraft after the junior product’s launch was a 32.8 percent swoon between October 2012 and June 2013. Looking back at the products’ performance, we can see the effect of compounding on each product’s return during this period.

Pay attention, first, to the daily standard deviation column. Here’s the substantiation (or refutation) of each product’s leverage and tracking claim. The unlevered DGZ note’s daily risk pretty much matches that of the GLD trust. The double-short GLL and DZZ products are, more or less, twice as volatile as GLD. And then there’s DGLD. It was, indeed, about three times as volatile as GLD.

Now, turn your attention to the period returns. Look at the variance. Over nine months, gold lost a third of its value. But each of these products returned seemingly disparate results. GLL and DZZ both trebled the inverse of GLD’s period return. DGZ’s return was effectively levered by a third.

And DGLD? Its period return was more than five times GLD’s inverse.

The reason for such incongruent returns is simple compounding. There were a lot of “down” days during that nine-month period, each one magnifying the ETPs’ index calculation bases.

Still, the products work as promised. Each delivered the requisite levered daily return. That’s all they can do. If you hold these products for more than one day, your ultimate return can be wildly different.

If there’s a sizable string of “down” days ahead for gold, the owners of these inverse products could make outsized gains. If the market grinds, though, returns could be more modest or, in fact, negative.

Caveat emptor.