Fairly early in an investor’s development comes the lesson about covered call writing. The lecture usually sounds like this: “Income can be generated in a flat market by writing calls against assets held in portfolio.”

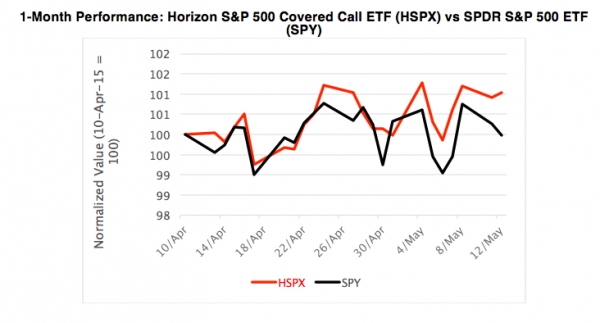

Well, you probably noticed the domestic equity market has been churning on either side of unchanged over the past month. Punditry now abounds with calls for no growth in U.S. stocks. Perfect timing, you’d think, for swapping into buy-write funds.

“Buy-write” is industryspeak for a simultaneous asset purchase and sale of associated call options. Take the PowerShares S&P 500 BuyWrite Portfolio (NYSE Arca: PBP), the genre’s big guy, for example. PBP writes covered calls on its portfolio of S&P 500 securities. At-the-money (ATM) calls, that is. ATM calls are those with strike prices roughly equal to the index level at the time of sale. The object is to maximize current income while accepting the risk of a capped upside if the index stocks rally sharply.

Another exchange-traded product, the iPath CBOE S&P500 BuyWrite ETN (NYSE Arca: BWV), follows the self-same strategy in a note format.

There’s a relative newcomer to the buy-write world that does things a little bit differently. The Horizons S&P 500 Covered Call ETF (NYSE Arca: HSPX) eschews the sale of ATM calls in favor of out-of-the-money (OOM) options.

OOM calls, being contracts with exercise prices above the current index level, garner smaller premiums because they’re not as likely to be exercised. The advantage to the writer? More upside potential on the underlying index portfolio. Case in point: HSPX is now breaking out to the upside of long-developing ascending triangle pattern.

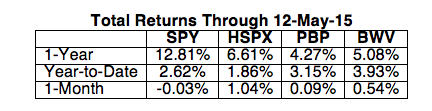

HSPX differs from PBP and BWV in a couple of other ways. First of all, the Horizon fund doles out monthly distributions, making it more attractive to income-oriented investors. PBP makes only quarterly payouts and BWV doesn’t make any distributions at all.

HSPX’s annual expense, at .65 percent, is also 10 basis points cheaper than its competitors.

If you’re wagering on a flat equity market for some time to come, HSPX seems the best bet provided you can accept the give-up of significant upside in a rally.

Brad Zigler is REP./WealthManagement's Alternative Investments Editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.