Many wealthy families desire to keep their primary residence and/or vacation homes in the family for several generations, many in perpetuity. There are over 8 million vacation homes in the United States alone, spread across places such as Arizona, Florida, Hawaii, Maine, Massachusetts (for example, Martha’s Vineyard and Nantucket) New York (for example, the Hamptons) and Texas. St. Croix, southern France, Costa Rica and Italy are some of the leading international locations for high-net-worth families to own second homes.1 Consequently, primary residences and vacation homes provide great opportunities for transfer tax planning and creditor protection.

Additionally, non-resident aliens (NRAs) are buying residential real estate in the United States at a record pace and are frequently transferring it to U.S. domestic trusts. Foreign buyers, led by the Chinese, account for approximately 7 percent of the $92.2 billion in home sales in the United States.2

Transfer to a Newly Created Trust

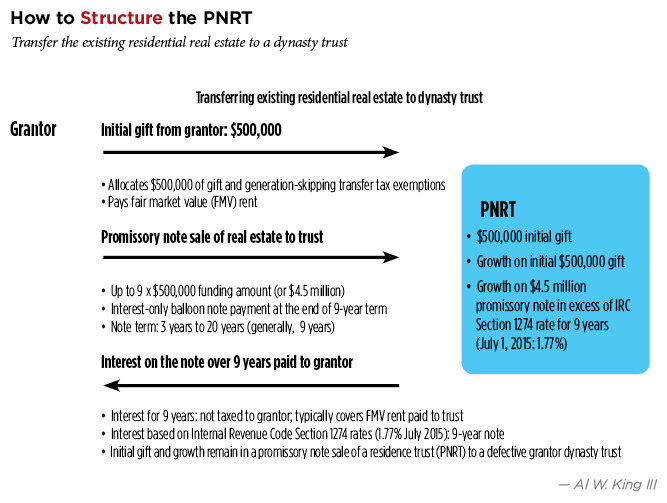

Many families use qualified personal residence trusts (QPRTs) to transfer primary residences and/or vacation homes out of their taxable estates. A great alternative to the QPRT is the promissory note sale of a residence trust (PNRT) to a defective grantor dynasty trust.3 The property in the PNRT is generally treated as not owned by the grantor for estate and gift tax purposes but owned by the grantor for income tax purposes.

The PNRT is basically a promissory note sale of real estate to an income tax defective grantor dynasty trust, which, among other advantages, leverages the transfer tax savings and provides protection from creditors. Generally, the PNRT is a dynasty trust funded initially with a portion of the residence or with cash and/or securities. The grantor then sells the home to the trust in exchange for a promissory note. The promissory note generally equals nine times the PNRT’s initial funding amount. For example, if the grantor initially funds the PNRT with $500,000, the grantor can sell a residence worth approximately

$4.5 million to the trust in exchange for a promissory note from the PNRT.

The grantor continues to live in the home and pays a fair market value rent to the PNRT.4 The PNRT pays interest on the promissory note to the grantor, which usually covers the price of rent and is generally federal and state tax-free to the grantor (Revenue Ruling 85-15). Trust assets secure the promissory note, and the principal on the promissory note can generally be repaid without penalty. The promissory note usually uses a 9-year term, but the term can generally be between three and

20 years. The PNRT pays interest to the grantor until the final year of the selected term, at which point it makes a single balloon principal payment to the grantor. All the appreciation on the promissory note (that is, the residence) remains in the PNRT, free of estate and generation-skipping transfer (GST) taxes in perpetuity if a dynasty trust is used. If the promissory note is still outstanding at the grantor’s death, the outstanding balance is generally included in the grantor’s estate, but it can also be structured to cancel at death as a self-cancelling installment note, which isn’t included in the grantor’s estate. Additionally, the grantor may purchase term insurance to pay the estate taxes owed if the grantor dies and the promissory note is totally or partially included in the estate. (See “How to Structure the PNRT,” p. 16.)

PNRT vs. QPRT

The benefits of the PNRT frequently outweigh the QPRT:

• With a PNRT, lease payments in excess of the promissory note interest rate remain in the dynasty trust for the family.

• With a PNRT, interest on the promissory note is paid to the grantor and, along with trust distributions, may offset lease payments to the PNRT. (There’s a requirement to lease the home at the end of the QPRT term without any offset.)

• A PNRT has better transfer tax benefits than a QPRT, which uses more of the grantor’s gift tax exemption.

• A PNRT provides an opportunity to benefit several generations as a generation-skipping dynasty trust versus a QPRT, which isn’t a generation-skipping trust.

• If the grantor dies before the end of the PNRT note term, only the unpaid balance of the note is included in the grantor’s estate. Alternatively, the promissory note can be structured to cancel at the grantor’s death (that is, a self-cancelling installment note) so that it’s not included in the grantor’s estate.

• If the grantor dies before the QPRT term ends, the full value of the home will be included in the estate.

• The grantor can possibly buy term insurance to pay for estate taxes on the promissory note or QPRT term.

• A PNRT has the ability to use capital gains exclusion on the sale of the home, like the QPRT.

• The grantor has flexibility to transfer the home out of a PNRT to allow for stepped-up basis at death or for any other reason, which isn’t allowed with a QPRT.

• Home equity is protected from future creditors for both a PNRT and a QPRT.

• A valuation discount for real estate is generally available in many instances for both PNRTs and QPRTs, but more leveraging options are available with a PNRT.5

• A PNRT promissory note uses an interest rate tied to the applicable federal rate (Internal Revenue Code Section 1274), which is generally much lower than the IRC Section 7520 rate used for the QPRT.

Purchase for Beneficiaries

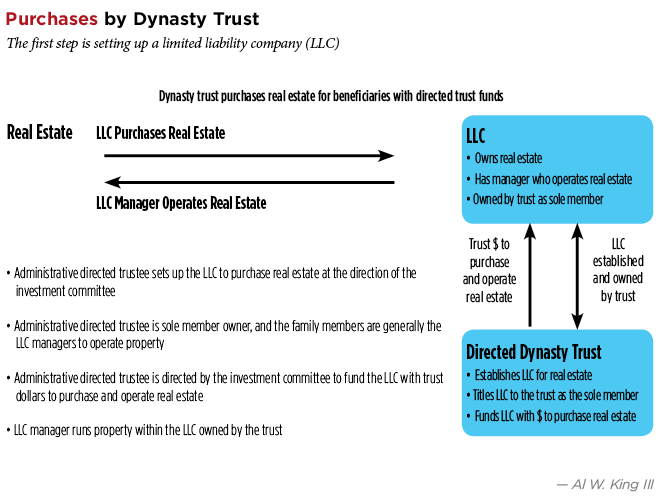

In addition to transferring existing real estate to a PNRT or a QPRT, many wealthy families frequently purchase real estate within an existing dynasty trust with existing trust assets, which generally allows the property to remain within the family forever while also avoiding transfer taxes and protecting against creditors. The strategy is to buy the home in trust for beneficiaries with existing trust funds, and they can use the home tax-free. If the parents whose trust is buying the home want to use it, they would need to rent it so there aren’t any IRC Section 2036 or 2038 issues.

Generally, this strategy works best with a directed6 dynasty trust established by the grantor with a trust protector, distribution trustee, investment trustee and administrative trustee. The directed administrative trustee forms a limited liability company (LLC), usually in the same state as the trust situs, though it’s not required to be in the same state, and the administrative trustee is also generally the sole member of the LLC.7 A family member or his advisors can generally serve as the LLC’s managers; the LLC purchases real estate and pays for related expenses with funds transferred from the trust to the LLC owned by the trust. If the existing trust isn’t a directed trust, the grantor can usually reform/modify or decant8 the trust into a directed trust to best accomplish this strategy. (See “Purchases by Dynasty Trust,” this page.)

There are many advantages to purchasing residential real estate within a trust with trust funds for the trust beneficiaries. This strategy is a great alternative to providing family members with down payments outright to buy a home outside of the trust:

• Real estate may remain in the family forever free of estate and GST taxes.

• Trust beneficiaries may be able to use the residence tax-free without paying rent.

• Beneficiaries can generally enjoy use of the home while keeping it protected from divorcing spouses.

• The LLC adds an extra layer of creditor protection: Most dynasty trust states have top rated charging order protection statutes as the sole and exclusive remedy for LLCs.9 Plus, they have sole member protection (that is, the trust is usually the sole owner/member).

LLCs with family managers provide ease of trust administration and maintenance of the residence. (See “Purchases by Dynasty Trust,” p. 17.)

Purpose Trusts

Purpose trusts are becoming another possible alternative to preserve a family residence or vacation home. Purpose trusts don’t have any beneficiaries. Their sole purpose is to care, protect and/or preserve an asset, such as a residence or vacation home. Not all states have broad statutes to accommodate this purpose, and many have limited durations. There are a few states, however, that allow for broad and flexible perpetual purpose trusts. Consequently, this alternative is an option that’s becoming more popular and warrants consideration.10

REHT: Privacy

Privacy is also very important to many wealthy families. Unfortunately, a quick title search by a prying third party can easily uncover details of real estate ownership. A real estate holding trust (REHT) can provide a great solution because a title search will generally only turn up the name of the trust and trustee. A REHT is generally revocable with its own tax ID number, which maximizes flexibility and may keep real estate out of probate. This is particularly valuable when the property is an out-of-state vacation home that would otherwise be subject to burdensome and expensive ancillary probate.

For this strategy to work, the grantor generally transfers real estate to a revocable trust. The trust holds title to trust property, either directly or through an LLC, with the trustee as the sole member. The strategy provides total flexibility with the option to transfer real estate out of the trust or to terminate the trust, if desired by the grantor.

The key benefits of the REHT are:

• Privacy, because the trust and trustee own the property on title records.

• Avoidance of probate and ancillary probate when the trust owns an out-of-state vacation home.

• Grantor maintains all of the income tax advantages of owning the home outright.

• Protection in the event the grantor becomes mentally incapacitated (that is, because the REHT pays the grantor’s bills and living expenses) for the residence and/or vacation home.

Purchases by Foreign Families

As previously mentioned, foreign families are also purchasing U.S. residential real estate at a record pace. Because the estate and GST tax exemptions for U.S. situs assets (that is, domestic real estate) owned by foreign families are so low ($60,000),11 these foreign families generally will look to purchase U.S. residential real estate in a trust with a U.S. trustee, particularly if their children are U.S. citizens or hold green cards. Many NRAs buy these homes as residences, vacation homes or for children when they’re in school in the United States. The domestic trust will generally remove the U.S. situs real estate from the U.S. transfer tax system (in perpetuity if a dynasty trust), as well as prevent any inputed income that might be generated by usage of foreign family members if the domestic real estate was owned by an offshore entity or trust.12 The trust also provides excellent creditor protection advantages.

Miscellaneous Considerations

Trusts can provide a great wrapper for residential real estate, but families taking advantage of this strategy also need to take into account the effect that these strategies may have on any possible homestead exemptions and/or favorable federal, state or local income or any other tax benefits associated with residential real estate. A grantor considering these strategies needs to consider possible marital property issues of transferring existing residences to the trust. In addition, if the trust isn’t directed, the grantor must review Prudent Investor Act issues of holding real estate in a delegated trust. Generally, these trust strategies for residential real estate result in many benefits to a family and don’t pose problems, but clients and their advisors need to review all aspects of such strategies prior to implementation.

Endnotes

1. Al W. King III, “The Top Ten Reasons International Families Establish U.S. Trusts—Why? How? Once a No-No, Now Commonplace,” Fourth Annual STEP/UCLA School of Law Institute on Tax, Estate Planning and the Economy (Jan. 22, 2015).

2. Ibid.

3. Kenneth A. Ziskin, “The Home Security Trust—Better Than A QPRT on Steroids,” Trusts & Estates (October 2010), at p. 66. Some of the more popular dynasty trust states are Alaska, Delaware, Nevada, New Hampshire, South Dakota and Wyoming. Please note the promissory note sale of a residence to a defective grantor dynasty trust may generally also be accomplished with a non-generation-skipping transfer (GST) trust or GST trust with situs in the grantor’s resident state, but generally a directed dynasty trust state is desired.

4. Generally, the trust charges rent based on an appraisal of fair market value as determined by a qualified appraiser.

5. Undivided interest discounts; see Ziskin, supra note 3.

6. A directed trust structure is one in which an administrative trustee is being directed with regard to investment and/or distribution decisions. For example, a settlor appoints an investment committee or trust advisor who directs the administrative trustee to make all investment decisions. This setup may also be done relating to distributions and a distribution committee or advisors. See Al W. King III and Pierce H. McDowell III, “Delegated vs. Directed Trusts,” Trusts & Estates (July 2006), at p. 26. Most of the popular dynasty states are also directed trust states (Alaska, Delaware, Nevada, New Hampshire, South Dakota and Wyoming).

7. For asset protection purposes, it’s usually best when a directed trust is combined with sole member (that is, trustee) statutory protection provided by most of the top rated directed trust and dynasty trust states. For instance, Alaska, Delaware, New Hampshire, Nevada, South Dakota and Wyoming all allow single member limited liability companies (LLCs).

8. Rashad Wareh and Eric Dorsh, “Decanting: A Statutory Cornucopia,” Trusts & Estates (March 2012), at p. 22. Daniel G. Worthington and Mark Merric, “Which Situs is Best in 2014?” Trusts & Estates (January 2014), at p. 53.

9. A charging order only gives a creditor a distribution right of an LLC interest and doesn’t give a creditor any voting rights. A charging order is simply a right to a distribution, if one is ever made; however, it doesn’t give the creditor a right to force a distribution. Some states, like Alaska, Delaware, Nevada and South Dakota, provide that the charging order is the sole and exclusive remedy for creditors. This restriction means that other remedies, including equitable remedies, may not be available to the creditor.

10. Al W. King III, “Trusts Without Beneficiaries—What’s the Purpose?” Trusts & Estates (February 2015), at p. 7. Delaware and South Dakota have two of the broader, more flexible purpose trust statutes with unique perpetual unlimited duration statutes.

11. Internal Revenue Code Section 2106 (b); see note 1.

12. Hiring Incentives to Restore Employment Act of 2010 (Pub.L. 111–147, 124

Stat. 71, enacted March 18, 2010, H.R. 2847); see supra note 1.