The recently concluded 48th Annual Heckerling Institute on Estate Planning posed more questions than answers and challenged estate planners to take a fresh look at the role of income tax (and income tax basis) planning in advising our clients. More than one year has now passed since the paradigm shift in the overall estate planning landscape that was ushered in by the American Taxpayer Relief Act of 2012 (ATRA). Although ATRA instilled some degree of stability in the estate, gift and generation-skipping transfer (GST) tax systems through the elimination of sunset provisions to favorable exclusion amounts, tax rates and GST tax rules, the consensus at this year’s Heckerling Institute was that estate planning–particularly for clients in the $5 million to $10 million range–is much more complex than ever due to the multitude of variables that will have to be considered in a well-structured plan. Indeed, given that for 2014, up to $5.34 million ($10.68 million for a married couple) can pass free of federal estate tax, the new paradigm requires a case-by-case analysis of the role that income tax planning (and achieving a step-up in basis upon the surviving spouse’s death) now plays in light of our clients’ particular circumstances. More than ever, the need for flexibility is paramount.

Accordingly, the primary message from this year’s Heckerling Institute was that any lingering notion of a one-size-fits-all solution to estate planning must be immediately abandoned. Rather, every client’s circumstances must be carefully evaluated in light of the double step-up in basis that may be achievable through portability, taking into account the implications of state estate taxes. Simply put, estate planners must now become income tax law specialists to the same extent that they are estate, gift and GST tax law specialists.

What this all means in a practical sense is that preserving the ability to delay decisions to the post-mortem context (such as through qualified disclaimer planning and the use of Clayton qualified terminable interest property elections) is now the name of the game. In addition, opportunities must be aggressively mined to force estate tax inclusion in non-estate taxable estates (taking into account state estate taxes) to fully utilize the tremendous vehicle for obtaining a tax-free step-up in basis that ATRA can provide.

Income Tax Versus Estate Tax

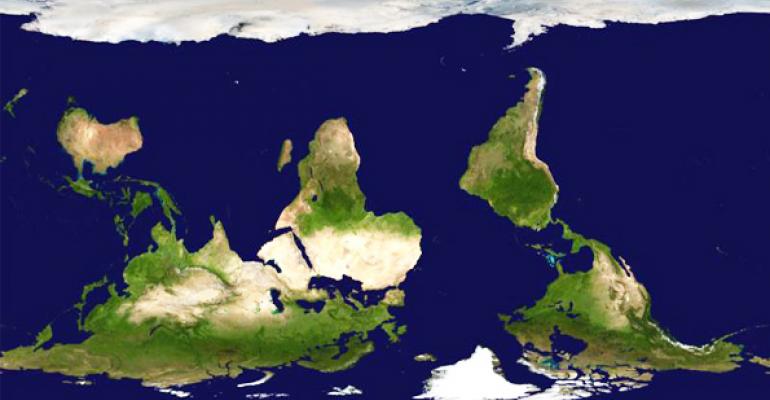

The most riveting plenary presentation this year was delivered by Paul S. Lee, a National Managing Director at Bernstein Global Wealth Management. Lee challenged the audience to accept that the world has now been turned upside down and that with the increase in the federal applicable exclusion amount to $5.34 million in 2014 ($10.68 million for a married couple) considered in tandem with the permanence of portability of the deceased spouse unused exclusion (DSUE) amount, the best use of the applicable exclusion amount will often be to preserve it (as opposed to consuming it through lifetime gifts) to maximize the step-up in basis upon death (including upon the surviving spouse’s death). This is nothing short of revolutionary. If the name of the game has now changed to preserve applicable exclusion amount as the primary tax-driver in estate planning, all of the techniques in an estate-planner’s toolkit must be reexamined through a completely different lens that carefully scrutinizes whether a lifetime transfer constitutes a justifiable expenditure of the applicable exclusion amount, all things considered. Thus, strategies that minimize the use of the applicable exclusion amount–such as grantor retained annuity trusts (GRATs) 1 and loans and sales to intentionally defective grantor trusts (IDGTs) 2–can be expected to be among the most favored techniques in this brave new world.

In addition, proactive tax basis management becomes extremely critical. The old stalwart of planning with IDGTs can be extremely helpful here because in Revenue Ruling 2008-22, the Internal Revenue Service held that the grantor’s retained power under IRC Section 675(4)(C)3 to substitute assets of equivalent value in a non-fiduciary capacity won’t trigger estate tax inclusion under IRC Section 2036 provided that adequate fiduciary safeguards are in place to ensure that the value of the assets swapped into the trust are equivalent to the value of the assets swapped out of the trust. Thus, swapping high-basis assets (such as cash) into an IDGT in exchange for low-basis assets held by the IDGT (such as publicly traded securities with a low-cost basis) can be expected to be in vogue.

Moreover, Lee posited that partnerships (and limited liability companies) may provide the ultimate vehicle for proactive tax basis management. For example, a partial liquidation of partnership assets in favor of a senior generation family member when an IRC Section 754 election is made could potentially “strip basis” from the distributed assets and cause the amount of the stripped basis to be allocated among the remaining undistributed partnership property.4 Presumably, substantial partnership interests in such partnership may be held by younger generation family members or trusts established for their benefit. The distributed assets whose basis has been stripped (to give them a zero tax basis) would then benefit from a step-up in basis if the senior generation family member were to die holding them.5

In addition, this new world of proactive tax basis management recognizes that every U.S. citizen and resident possesses a valuable asset that can be put to productive use – namely, a federal applicable exclusion amount that in 2014 can shelter up to $5.34 million from estate tax while facilitating a step-up in basis for assets to which it’s applied. Thus, estate planners can be expected to include provisions within their wills and trust instruments that confer upon an independent trustee or a trust protector the ability to grant a general testamentary power of appointment (POA) to beneficiaries so that a step-up in basis of the assets that are subject to such POA may be achieved upon the beneficiary’s death. To the extent that existing trusts don’t already contain such provisions, a trust decanting or modification may be employed to engineer this result.

Moreover, determining the appropriate course to take is highly sensitive to the particular state in which the client resides, because some states (such as California and Florida) don’t impose any state estate tax or have community property law concepts (such as California) that will automatically facilitate a double step-up in basis upon the first spouse’s death. In sharp contrast, other states (such as New York) impose substantial estate taxes (although the New York estate tax laws may now be in flux). Further, we now live in a world in which, depending on the decedent’s state of residence at the time of death and where the beneficiaries reside, the spread between the aggregate estate tax rate (federal and state) and the aggregate capital gains tax rate (federal and state) for appreciated property may be relatively small, particularly when one takes into account the 3.8 percent additional tax on net investment income under the Patient Protection and Affordable Care Act.

Grappling with Portability

Now that portability of the DSUE amount is permanent under ATRA, estate planning advice to married clients who have significant amounts of unused applicable exclusion amount should generally consider the pros and cons of relying on portability either in lieu of, or in conjunction with, establishing a traditional credit shelter trust. The consensus at Heckerling (including in the excellent presentations by the Recent Developments Panel and by Thomas W. Abendroth, a partner at Schiff Hardin LLP) was that planning for married clients in the $5 million to $10 million range is much more difficult than planning for married clients who are either well above or well below that range.

ATRA established as permanent the portability of the applicable exclusion amount between spouses when the first spouse to die is either a U.S. citizen or a U.S. resident. Portability, in a nutshell, involves the carryover of the first decedent spouse’s unused applicable exclusion amount to the surviving spouse for estate and gift tax purposes (but not for GST tax purposes) and can be accomplished through the executor’s election on the estate tax return of the first spouse to die.

Portability will ensure a step-up in basis of the subject assets at the surviving spouse’s death and may appeal to clients as a reason to avoid having to plan their estates. The consensus at Heckerling, however, was that portability doesn’t dispense with the need to consider using credit shelter trusts (which could include a trust of which the sole lifetime beneficiary is the surviving spouse) in estate planning in many instances. Indeed, it’s incumbent on the estate planner to “drill down” on the facts to advise the client how best to proceed.

The following considerations may continue to support the use of credit shelter trusts in lieu of relying exclusively on portability:

- There are substantial non-tax benefits to be derived from using trusts, including asset protection, asset management and restricting transfers of assets by a surviving spouse (particularly if there are children from a prior marriage, or concerns about a subsequent remarriage).

- Portability doesn’t generally apply for state estate tax purposes, including in “decoupled” states such as New York. Thus, a well-drafted estate plan for a New York married couple might still involve funding a credit shelter trust with the largest amount capable of passing free of New York State estate tax (currently $1 million) to avoid wasting the New York State estate tax exemption of the first spouse to die.

- A step-up in basis may nevertheless be achieved over assets in a credit shelter trust by giving the surviving spouse a general POA over the property of the credit shelter trust (such as by allowing the surviving spouse to designate by her will that some portion of the trust property shall be paid over to her estate upon her death) in a formula amount equal to the largest amount capable of passing free of federal estate tax as finally determined for federal estate tax purposes. This general POA will cause estate tax inclusion over the property that’s subject to it, thereby producing a step-up in basis to such extent.

- The DSUE amount isn’t indexed.

- Depending on subsequent facts and circumstances, the DSUE amount may be lost if the surviving spouse remarries and survives his next spouse.

- With portability, growth in assets isn’t excluded from the gross estate of the surviving spouse. In contrast, growth in the assets of a credit shelter trust is excluded from the gross estate of the surviving spouse.

- A credit shelter trust can be used to shield hard-to-value assets from valuation disputes with the IRS on the death of the surviving spouse, because such assets wouldn’t be part of the surviving spouse’s gross estate.

- There’s no portability of the GST tax exemption. So planning with trusts (including lifetime QTIP trusts for which a reverse QTIP election under IRC Section 2652(a)(3) would be made) will still generally be warranted if GST tax planning for grandchildren and more remote descendants is desired.

- A well-conceived estate plan could involve relying upon the portability of the applicable exclusion amount and then having the surviving spouse gift the DSUE amount to an IDGT to obtain the benefits of grantor trust status that generally wouldn’t be available for a credit shelter trust, including effective income tax-free compounding of the trust principal and the ability to “swap” assets from time to time to achieve a de facto step-up in basis upon the second spouse’s death.

In light of the Supreme Court’s decision in United States v. Windsor,6 which invalidated as unconstitutional Section 3 of the Defense of Marriage Act (which had defined marriage as requiring a legal union between one man and one woman), portability is also available to same-sex couples. In Rev. Rul. 2013-17,7 the IRS addressed certain implications of the Supreme Court’s decision in Windsor, ruling that a “state of celebration” test applies. Under this Rev. Rul., same-sex couples who are legally married in states or foreign countries that recognize the validity of their marriage will be treated as married for all federal tax purposes, even if they live in a state or other jurisdiction that doesn’t recognize same-sex marriages. So estate planning for same-sex couples must now consider the same factors concerning portability that apply to planning for opposite-sex couples.

Endnotes

1. A grantor retained annuity trust (GRAT) involves a grantor’s transfer of property to an irrevocable trust (the GRAT) for a specified number of years, retaining the right to receive an annuity (a fixed amount payable not less frequently than annually). Upon termination of the GRAT, the trust assets are paid to the remaindermen named by the grantor, typically his children, or to a trust of which the grantor’s spouse and issue are beneficiaries. In essence, the grantor creates a GRAT to transfer its remainder at termination. This transfer is a taxable gift that is deemed to occur upon creation of the GRAT. The remainder is valued for tax purposes by subtracting the interest retained by the grantor—the annuity—from the value of the initial transfer into the GRAT. The Internal Revenue Service requires that the value of the retained annuity be calculated on an actuarial basis using the assumed interest rate published by the IRS under Internal Revenue Code Section 7520 that’s in effect for the month that the GRAT is funded.

2. An intentionally defective grantor trust (IDGT) is an irrevocable trust for which one of the “grantor trust” provisions set forth in IRC Sections 671-679 is triggered. Transfers by the grantor to the IDGT will be complete for gift tax (and estate tax) purposes but incomplete for income tax purposes. Therefore, if the trust is drafted properly, the income and gains of the trust will be taxable to the grantor, but the assets transferred to the trust by the grantor will be excluded from the grantor’s gross estate upon death. Further, the grantor’s payment of income taxes attributable to the trust won’t constitute a gift for federal gift tax purposes because the grantor is discharging his own legal obligation. See Revenue Ruling 2004-64. In addition, transactions between the grantor and the grantor trust will not be taxable events. See Rev. Rul. 85-13. These tax benefits of IDGTs under current law are all on top of the wonderful asset protection and property management benefits that trusts can provide.

3. All references to “IRC” are to the Internal Revenue Code of 1986, as amended.

4. See IRC Section 734(b).

5. See IRC Section 1014.

6. United States v. Windsor, 570 U.S. ___, 133 S.Ct. 2675 (2013).

7. Rev. Rul. 2013-17, 2013-38 I.R.B. 201.