The deductibility of investment advisory expenses often generates confusion. This is further complicated by new rules for corporate fiduciaries. In this article, the third in a series, we suggest potential methodologies for unbundling fiduciary and investment advisory expenses as required by the new regulations.

“Any Reasonable Method”

The regulations state that “any reasonable method” may be used to allocate a bundled fiduciary fee between costs subject to the 2 percent floor and those that aren’t. This category includes the allocation of a portion of a fiduciary commission that is a bundled fee to investment advice. Some facts that may be considered in determining a reasonable method are:

- Whether a third-party advisor would have charged a comparable fee for similar advisory services; and

- The amount of the fiduciary’s attention to the trust or estate that is devoted to investment advice as compared to dealings with beneficiaries and distribution decisions and other fiduciary functions.

The regulations also seem to permit the use of multiple factors in allocating fees, allowing for more factors that might support a smaller allocation to investment advice.

A method resulting in the smallest allocation of investment management expenses could be considered reasonable. Further, it’s important to note that consistency is not required for a fiduciary of multiple types of trusts and estates. One method may be applied to one trust and a completely different method applied to another. The following methodologies should be considered in allocating fees:

- Time spent on investment management duties as a percentage of trust or estate assets requiring investment management;

- The number, percent and type of professionals providing services to trust;

- Tracking time spent on investment advisory versus fiduciary activities;

- Comparison to fees charged by investment managers;

- Comparison to costs of fiduciary insurance;

- Comparison of fees paid to a fiduciary with no special investment skill; and

- Comparison of fees paid to a directed trustee.

Here are some hypothetical examples of how three of these methodologies might work.

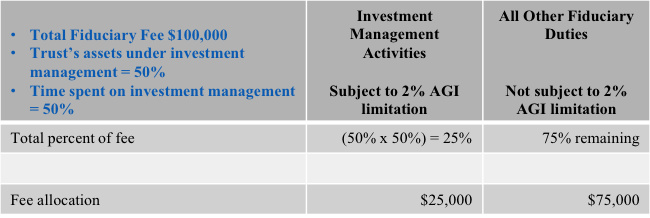

Example 1—Time Spent on Investment Management Duties Based on Percent of Assets Requiring Investment Management

A trust incurs a $100,000 fiduciary fee. Only 50 percent of the trust’s assets are under investment management. As such, the time spent on investment management duties can be, at most, 50 percent. After applying both of these reductions to the original $100,000 fee, we reach a minimum possible allocation for investment management expenses of $25,000. In this case, $25,000 of the $100,000 fiduciary fee would be subject to the 2 percent floor, leaving $75,000 fully deductible above the line.

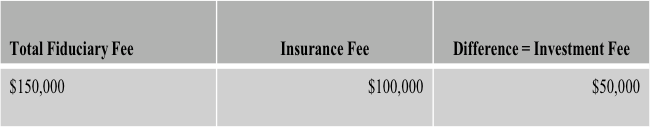

Example 2—Comparison to Costs of Fiduciary Insurance

A trust incurs a $150,000 fiduciary fee. Liability insurance as trustee costs the fiduciary $100,000. The remaining $50,000 is the cost for investment management. As a result, $50,000 of the $150,000 fiduciary fee would be subject to the 2 percent floor, leaving $100,000 fully deductible above the line.

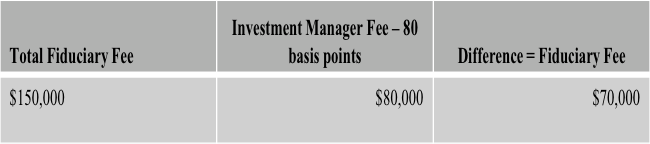

Example 3—Comparison Fees Charged by Investment Managers

A trust incurs a $150,000 fiduciary fee for $10 million of assets under investment management. The fee for a similar investment management-only relationship would be 80 basis points or, in this case, $80,000. The remaining $70,000 is for fiduciary duties. As a result, $80,000 of the $150,000 fiduciary fee would be subject to the 2 percent floor, leaving $70,000 fully deductible above the line.

Though a good look at the very basics, these examples represent only a small sample of the broad range of possibilities. Fiduciaries must also consider the cost benefit to the trust in determining a reasonable method. In some cases, because the trust would not receive a material deduction in any case, applying a time-consuming and costly reasonable methodology to maximize the deduction may not be worthwhile. Whether or not to pursue this strategy is yet another important consideration for fiduciaries as they navigate these new rules.