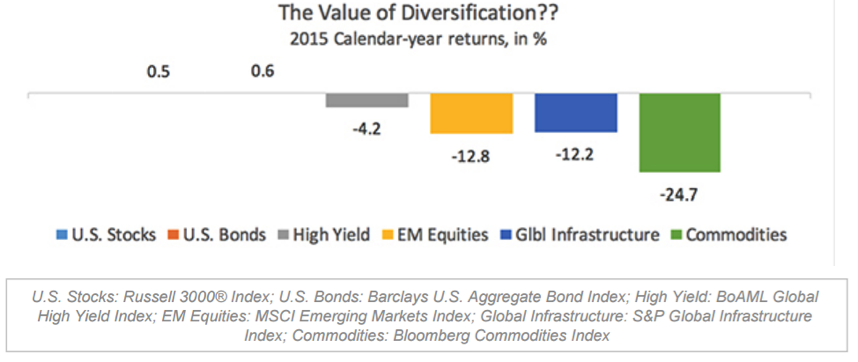

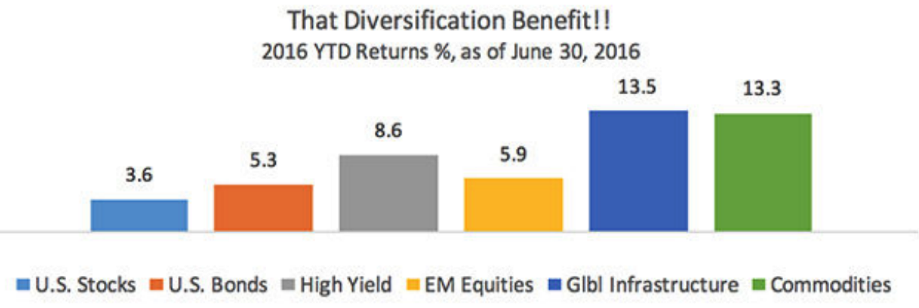

In a certain sense, it has been easy to make money in the capital markets over the last few years. For many U.S. investors, the winning approach has been "The simpler, the better." In many cases, an allocation to some mix of U.S. stocks and bonds has done better than more diversified portfolios targeting a similar level of risk. Indeed, for many of those investors who lean towards global diversification, it has been a challenging time. Those asset segments that are typically added to a mix of U.S. stocks and bonds either to enhance return potential or decrease overall portfolio volatility—such as high yield, emerging market equities, global infrastructure and commodities—have broadly failed to accomplish either of those tasks. The chart below shows how these "diversifiers" fared in 2015. On the face of it, not a pretty picture:

In contrast, the first half of 2016 has been a welcome reprieve—and boost of confidence—for many of those investors who maintained their broad diversification discipline. Many of these asset segments have produced strong results against a backdrop of volatile equity markets.

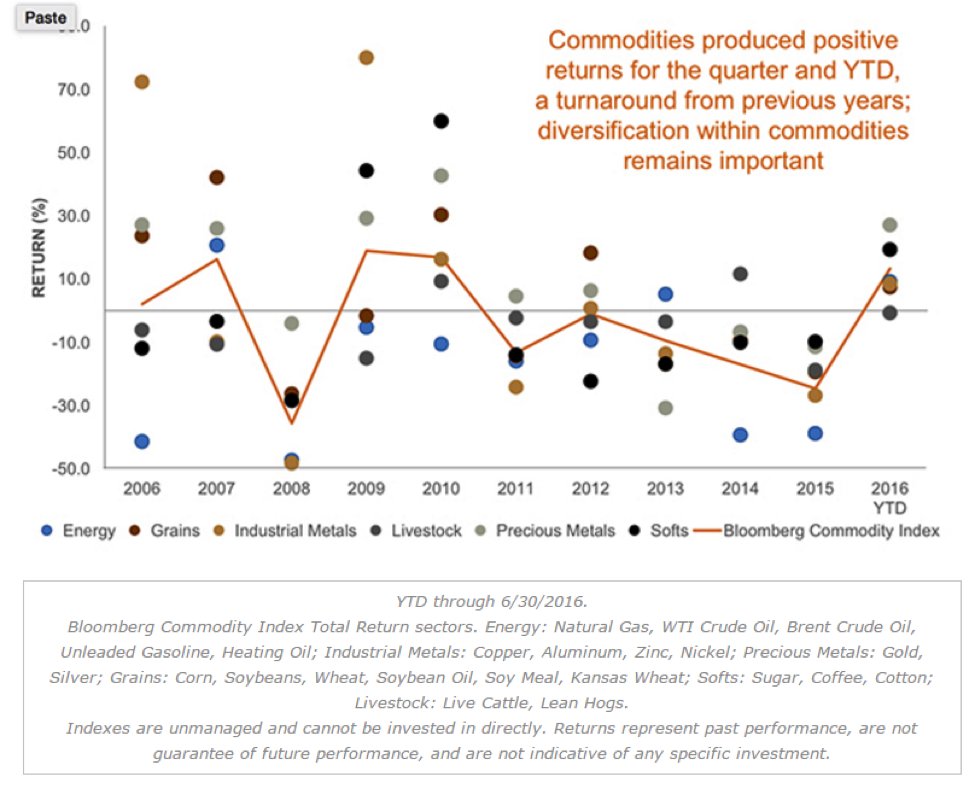

This sense of relief is particularly strong for those who invested in commodities, which have had a rough ride over the past five years. Not only did commodities (Bloomberg Commodities Index) drop almost 25 percent in 2015, but for the five years ending December 2015 commodities lost 13.5 percent per year. Much of that disappointing performance is due to the drop in energy prices as oil prices went from a high of $140 a barrel in 2008 to a recent low of below $30 per barrel in February 2016.

That said, not all commodities fared as poorly as oil, though admittedly energy tends to be the highest-profile sector amongst the commodity markets. As the chart demonstrates below, commodities are made up of much more than just energy/oil.

As the chart above shows, the individual commodities sectors have posted a wide range of results and a great deal of diversification amongst each other, which is a good reason that commodities tend to act as a good diversifier for the other assets in an investment portfolio as well. The last few years have been difficult from a return perspective, but commodities tend to run in cycles, and this year's strong start may be the beginning of a new, more positive cycle for the asset class. Even if not, it is very likely to expect that they will still deliver diversification benefits to the rest of the portfolio.

The Bottom Line

It can be very difficult to stick with an investment that "hasn't been working," especially when it is thought of more as a "diversifier" than the "foundation" of a portfolio. However, before abandoning any investment, it's best to revisit the reason for holding it and reassess its potential impact on the portfolio in the future. We believe that the favorable performance reversal of diversifiers in the first half of 2016 is a good example of that.

Mike Smith is Consulting Director for PCS Consulting Services Group, Russell Investments.