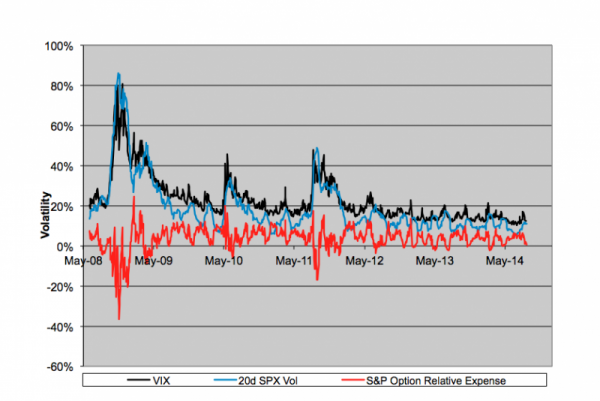

“A bargain,” said one-time guru Franklin Jones, “is something you can’t use at a price you can’t resist.” Such, I think, is often the case for option volatility. We’ve all heard how low the VIX “fear index” is now. VIX—a truncation of “volatility index”—is the market’s expectation of near-term volatility derived from options on the S&P 500 Index (SPX). Generally, VIX values greater than 30 signal heightened investor uncertainty while readings below 20 indicate some degree of complacency.

The numbers represent percentages--specifically, the standard deviation in the index price forecast by at-the-money calls and puts. Options are considered expensive when implied volatilities are high and cheap when volatilities are low. Ideally, option buyers purchase contracts as volatilities ebb while writers use volatility spikes to sell rich contracts. Trouble is, raw volatility numbers aren’t really a good guide to option bargains. You need context to discern cheap from dear. A chart can certainly help.

VIX is depicted by the black line. You’ll note, too a blue line which represents actual index volatility over the preceding 20 trading days. By and large, option-implied and historic volatility move in unison but there are times when the metrics diverge. The degree of divergence is depicted by the red line. And is this line you can use to make quick-and-dirty assessments of option bargains.

The “relative expense” of at-the-money SPX options averaged 3.72 percent over the past year, ranging from a very rich 9.97 percent to a bargain-basement -2.18 percent. There’s your context. If relative expense heads south of the zero line, it’s time to start shopping for contracts. But that’s a rare occurrence.

The question, then, becomes “puts or calls?” And that’s where trend analysis comes in. Is the prevailing pattern expected to continue or reverse? Are you a bull or a bear?

Of course, if you’re not willing or able to buy options, these cheapies may not be bargains at all.

Brad Zigler pens Wealthmanagement.com's Alternative Insights newsletter. Formerly, he headed up marketing and research for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.