Well, 2015 has gotten off to an, um, interesting start. Interesting as in interest. A month ago, we (okay, I) cautioned investors and advisors (“Fretting About Deflation”) about the precipitous fall in the daily inflation index. The index – a measure of the relative value of bonds to commodities – has now dipped below the nadir reached in the 2008 recession.

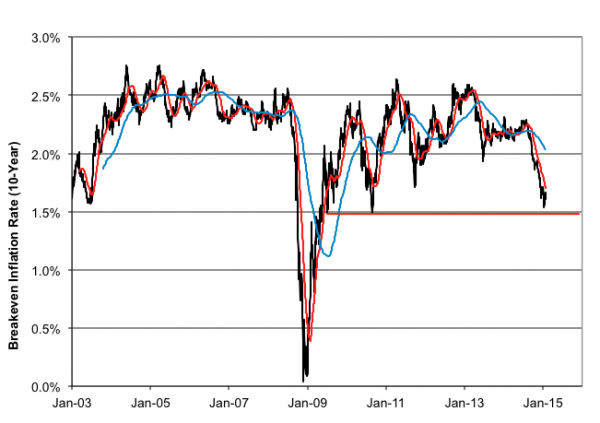

Meantime, the 10-year breakeven inflation rate (Treasurys over TIPS) has dipped well below the Fed’s target, but seems to have found some support at 1.56 percent. There’s, in fact, been a recent rebound, in spite of the continuing collapse in crude oil prices. Below the current market is twice-tested support at 1.49 percent. In any event, current deflationary expectations are much more mild than those that paralyzed investors in 2008.

You can’t dismiss, however, the wholesale sell-off in inflation ideation over the past six months. The ten-year BEI has nosedived about 70 basis points since last summer. And, wouldn’t you know it, your ability to hedge against that decline has been crimped by the recent shuttering of deflation-fighting ETFs.

On January 9, ProShares liquidated its UltraPro Short 10-Year TIPS/Treasury Spread (NYSE Arca: SINF) and Short 30-Year TIPS/Treasury Spread (NYSE Arca: FINF) funds for, absent a more delicate explanation, lack of interest. In its nearly three-year life, SINF couldn’t attract more than $2.5 million in assets. The unlevered FINF portfolio amassed $4.3 million.

There’s still an exchange-traded deflation hedge available, though, It’s a note, not a fund. The PowerShares DB US Deflation ETN (NYSE Arca: DEFL) tracks an index designed to gain a point for every one-basis point (0.01 percent) decrease in the market’s future inflation expectation. The index is based on the duration-adjusted performance of a nominal short positions in 5-, 10- and 30-year TIPS and long positions in Treasury bond futures.

That 70 basis point drop in the BEI translates into a 16 percent increase in DEFL’s value. You might say, then, that there’s inflation to be found in deflation. [Groan!]

Brad Zigler is REP./WealthManagement's Alternative Investments Editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.