Looking for the bellwether of the U.S. economy? Think consumer goods stocks. First, there are staples. These are outfits that make the stuff people constantly want, companies like Proctor & Gamble (NYSE: PG) or Kimberly Clark (NYSE: KMB), and the stores that peddle those goods, such as Wal-Mart (NYSE: WMT) and Costco (Nasdaq: COST).

You can wrap all 40 or so of the S&P 500’s consumer staples stocks into one investment through the Consumer Staples Select SPDR Fund (NYSE Arca: XLP). A lot of people, in fact, have done just that in 2014. XLP has risen 10.5 percent since the top of the year, bettering the performance of the broader S&P index by a full percentage point.

Then there’s the consumer discretionary sector, populated by companies purveying automobiles and other durable goods as well as diversions such as movies and TV programming. You know, General Motors (NYSE: GM), Home Depot (NYSE: HD) and Comcast (Nasdaq:CMCSA) and the like. Year to date, this segment, proxied by the performance of the Consumer Discretionary Select SPDR Fund (NYSE Arca: XLY), has topped out with a feeble 1.7 percent gain. That’s knitted the brows of the glass-half-full folks.

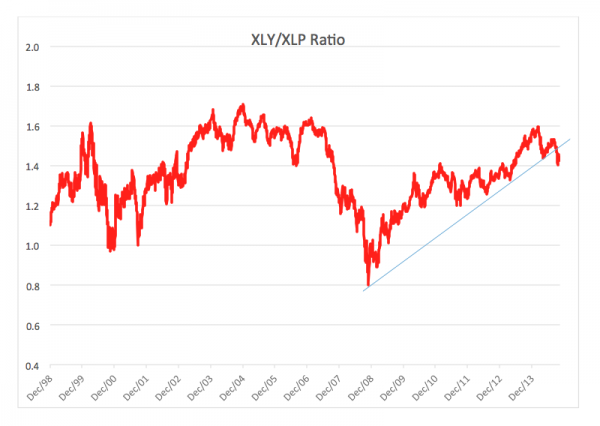

Why? Well, the consumer discretionary sector tends to outperform consumer staples when the economy is buoyant and expanding, it lags when the economy is struggling or contracting. You can read the current trend in the chart below which plots the ratio of XLY’s price to XLP’s.

At the beginning of the year, the ratio was nearly 1.6. now it’s 1.4. XLP’s plainly been losing ground.

Cause for wholesale panic? Nah. But it should make investors cautious. Notice that the last time the ratio peaked near 1.6 was June 2007. Support was then broken in November 2007, presaging a precipitous decline in the S&P 500.

Technically, XLP – now trading at the $47 level — had been aiming for a $54 objective. It may yet attain that price, but investors and their advisors should consider a close under $44 as a reversal of the ETF’s current bull move.

Brad Zigler is former head of marketing and research for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.