As more wirehouse registered reps join RIAs or start their own, as income tax rates rise, and as Baby Boomers continue their march into retirement, expect investments in no-load variable annuities to grow.

Over the past five years ending in 2009, sales of no-load variable annuities totaled $16 billion, representing about 2.2 percent of total deferred variable annuity sales, according to Morningstar. Some believe that the amount invested in no-load variable annuities could double over the next five years.

In fact, a number of insurance companies have lately been launching inexpensive no-load annuities targeted at the wave of registered reps becoming RIA adviser reps. Jefferson National rolled out its first flat-fee annuity in 2005. But over the last couple of years Fidelity, Ameritas Insurance, Pacific Life, MetLife, Prudential and Nationwide Financial have rolled out their own versions of this product, too.

“Broker-dealers are demanding no-load variable annuities and insurance companies are meeting the demand,” says Tamiko Toland, editor of Annuity Insight. ” Insurers are aggressively pursuing the no-load market with new product designs.” Advisors now have 95 no-load or low-cost variable annuities to pick from, according to Morningstar.

The average broker-sold variable annuity has back-end surrender charges and annual costs as high as 300 basis points, including fund management fees, mortality and expense charges and principal guarantees. Surrender periods can last up to seven years.

The no-load annuities, in contrast, are low cost and have simplified features and no surrender charges. Toland says the costs on these newer products, which include mortality and expenses charges, fund management fees and Guaranteed Lifetime Withdrawal Benefit fees, tend to run at about 200 basis points annually.

For example, Jefferson National’s “Monument Advisor,” is a commission-free and surrender fee-free variable annuity. The product has no death benefit guarantee and no living benefit guarantee. Instead, the insurer charges a flat $20 monthly fee, regardless of the annuity’s size. Jefferson National’s product provides over 250 investment options, including Rydex and Pro Funds, which offer alternative assets and bull and bear market funds.

“Tactical asset allocation is playing a bigger role in asset management strategies,” says Jefferson National President Larry Greenberg. Since the no-load annuity was launched in 2006, $600 million has flowed into it. The average policyholder is in his or her 50s and invests $200,000. The cost on that $200,000 is just 12 basis points in insurance charges. Mutual fund management fees average about 50 basis points.

“We stripped out the costs and pulled out the riders,” Greenberg said. “We streamlined the product as a tax-deferred investment. Our product provides four times the tax-deferral… (of a) typical variable annuity.”

Fidelity Investments also offers a stripped down no-load product on its advisor platform. The Fidelity Personal Retirement Annuity, with $947 million in assets, charges just 35 basis points. Advisors have 50 funds to pick from with an average cost of about 50 basis points. The annuity does not offer death or living benefit guarantees.

“We are seeing more interest in our annuity and I expect to see greater interest in the future,” says John Danahy, senior vice president at Fidelity Investments Life Insurance Company, Boston. “The focus of advisors is around taxes because their high-net-worth clients are going through a period of tax increases.” Simplified products, he says, appeal to RIA adviser reps because they understand the impact of tax deferral, particularly on fixed income investments.

Of course, the low-cost products of Jefferson National and Fidelity Investments aren’t for everyone. They are best suited for those who want to invest large sums, and are not concerned about a principal guarantee.

But there also are no-load variable annuities that offer the popular Guaranteed Lifetime Withdrawal Benefits, for about an extra 100 basis points annually. Fund fees range from 30 basis points to about 100 basis points annually. As with the Jefferson and Fidelity products, there are no back-end surrender charges

At Ameritas Life Insurance Co., Lincoln, NE, investment advisors deal directly with Ameritas or go through Pershing Securities, says Patricia Reiners, Ameritas assistant vice president. The insurer has $300 million in its two no-load variable annuity products for investment advisors.

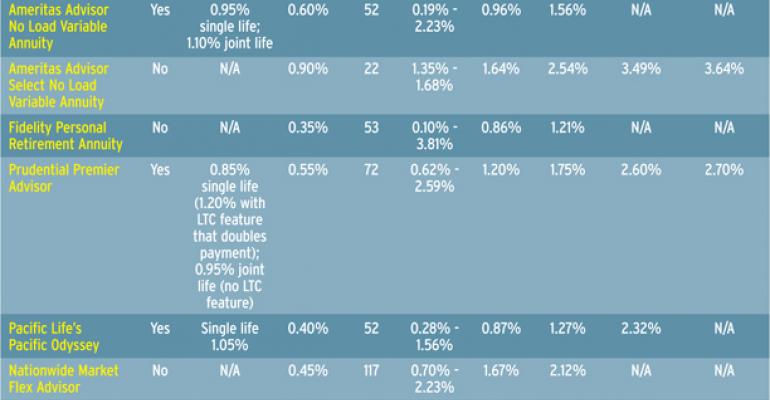

The “Ameritas Advisor No-Load Variable Annuity,” is a multi-manager annuity with funds by Vanguard, PIMCO, Fidelity and PRO Funds. The product comes with individual and spousal Guaranteed Lifetime Withdrawal Benefits for annual fees of 95 and 110 basis points, respectively. Mortality and expense charges are just 60 basis points and fund management fees range from about 30 to 100 basis points.

Last November, Ameritas began offering the “Ameritas Advisor Select Variable Annuity,” which offers 22 Pro Funds mutual funds for active money managers who want to invest in alternative asset classes. “Investment advisors who favor tactical asset allocation use this annuity because the Pro Funds are designed for up and down markets.”

Other no-load variable annuities, which may be available on broker-dealer platforms, include Pacific Life’s Pacific Odyssey variable annuity and Prudential’s Advisor Choice Variable Annuity. Nationwide Financial also has a no-load variable annuity available through Charles Schwab and Bank of America.

If your clients want to deal directly with no-load investment companies, low-cost choices include Vanguard’s “Variable Annuity.” The product comes with a death benefit guarantee but no living benefit protection. Total costs run about 60 to 80 basis points annually, including its mutual funds.

Last November, Fidelity teamed up with MetLife to offer “The MetLife Growth and Guaranteed Income” variable annuity. This no-load variable annuity is exclusively distributed by Fidelity. Total annual charges range from 190 to 205 basis points annually.

As with anything, there is no free lunch with no-load variable annuities. “They turn capital gains and dividends into ordinary income,” warns Harold Evensky, a Coral Gables, Fla.-based RIA.

Financial research by William Reichenstein, professor of investment management at Baylor University, shows that investment advisors can do just as well after taxes by using tax efficient strategies in taxable accounts. Nevertheless, a no-load variable annuity can be an attractive option for a client who needs to unload a high-cost broker-sold product, but still wants a lifetime withdrawal benefit.

R.H. “Rick” Carey, president of RISE Enterprises, Inc., Roswell, GA- based consulting firm, recommends that advisors do a cost-benefit analysis before investing in even a low-cost variable annuity with a lifetime withdrawal benefit.

“I don’t think there will be a stampede on the part of fee-only advisors to recommend even the lower cost (Guaranteed Lifetime Withdrawal Benefits),” he says. ”Pure income annuities will buy more income from fewer invested capital assets.”