Many advisors who work with ultra-high-net worth families worry that their clients’ children will go elsewhere for advice as soon as they have the chance. If you share this concern, you’ll be glad to hear that the majority of millennial family clients (ages 18 to 33) who participated in the FOX Client of the Future research study say that this isn’t their intent. That doesn’t mean you can sit back and relax.

While the essential value proposition for millennial family clients is essentially the same as it is for their parents and has been for their grandparents, what sets them apart are their expectations for how this value will be delivered. Here are three recommendations to help meet you build and maintain relationships with your millennial family clients.

Connect on a Personal Level

Millennials want to be understood, and they must feel like their advisors know and understand them to believe that they have their best interests at heart. Millennials must relate to their advisors on a personal level before they’ll trust them in an advisory capacity.

When you’re accustomed to turning to close relatives for financial advice and education, relying on outside advice can be very uncomfortable, explains Will, age 24. In a casual conversation, Will and his new advisor discovered that they shared a passion for hunting. After an expedition, the advisor set up a Dropbox so that he and his client could easily share photos of their mutual hobby. This simple gesture gave client and advisor a way to build a personal relationship as a foundation for their professional relationship.

It’s important to note that the millennial family clients FOX interviewed are members of the rising generation in families with multi-generational wealth who understand that wealth brings complexity. Therefore, these clients appreciate long-standing relationships with their advisors, placing a premium on their advisors’ knowledge of their family. Related to this point, millennial family clients say they don’t see age as a barrier to relationship building. However, they do worry that their advisors are going to retire, so a multi-generational approach to serving them makes sense.

Serve as a Coach or Mentor

FOX research shows that state-of-the-art advisors actively demonstrate they understand what their clients want and are there to help them achieve their goals. This helps build and maintain relationships. Millennial clients appreciate it when their trusted advisors not only help them achieve their goals, but also help them develop life-long skills that can be applied in other situations.

For goal-oriented, results-driven advisors, this type of client relationship and the shift in focus that it requires may feel uncomfortable. For millennials, it feels natural. Team sports were an important part of most millennials’ upbringing, and collaboration was an essential part of their education. Mercy, a 24-year-old law student and study participant, pointed out that she and her friends didn’t have bosses at their summer internships. They had mentors who got to know them personally outside of work. As a result, not only are millennials comfortable with the concepts of mentoring and coaching, but also, they value these types of relationships and continue to seek them out.

Provide Networking Opportunities

Often, when people talk about millennials and networking, it’s in the context of social media. However, the millennial family clients we spoke to were actively seeking to build their networks offline. To effectively help millennials network, it’s important to note that it’s more about “what you know” rather than “who you know” for this generation.

When one of our millennial study participants told her advisor that she wanted to pursue social impact investing, her advisor brought her new ideas and examples and invited her to be part of a professional networking group around social impact investing for women, which led to additional opportunities. “I like that she brings up things I wouldn’t have focused on,” says Maria, age 30.

Brought up to be collaborators and community builders, millennials are apt to create networks with specific goals in mind. They identify the talent or experience they need to achieve their goals, seek out individuals who can help them fill those gaps and invite them to team with them. If their advisors can help their millennial clients do this, it adds to their perception of value.

The Accelerator Effect

Millennials act as accelerators, quickly adapting to and often driving innovation and change. Responding to the unique preferences of these clients and working with your service teams to implement these three recommendations for your millennial clients will undoubtedly benefit your entire client base.

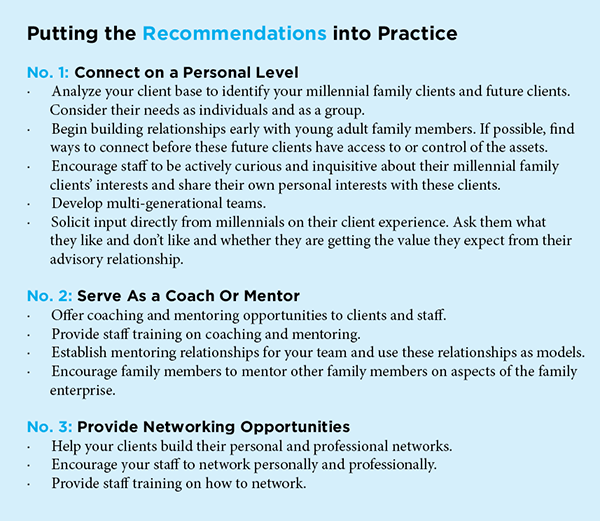

The box below explains how to put these recommendations into practice.