When it comes to considering, or reconsidering, a revenue model for your firm, the first question you should ask yourself is “What do I do for my clients?” Now, as you read this, you may find yourself thinking, “I know what I do for clients – and they know that I add value. Otherwise they wouldn’t continue to be clients.”

Don’t kid yourself. Consider the following issues carefully or, in our opinion, ignore them at your peril.

- What you do for clients, and what they value, are two very different things. If you don’t or can’t differentiate the two, you run the risk of focusing on things (like service and process) that anyone can deliver rather than what is unique to the relationship – the impact that you have on the lives of your clients.

- Inertia plays an important, but insidious, role. While your clients are very likely loyal, that doesn’t necessarily mean they are satisfied. Consider this: Thirty-three percent of clients who were dissatisfied with their advisory relationship have never thought about leaving, according to a recent study on advised investors from If Not Now Research. How does this relate to value? If you assume that what you are doing is right because clients stay with you, you may be making a big mistake.

- Clients don’t speak up. Sixty-four percent of dissatisfied clients said they had never raised a concern with their advisor. You may not know if something is wrong.

Why is this important?

Most of us look at our jobs from the inside out, not from the outside in. We can’t help it; we are immersed in our process and the day-to-day details of what we do. But taking a moment to look at our job from the outside—from the client’s point of view—can be an important wake-up call. You’ll see clients can’t understand every detail of what you do. Nor should they, just as you shouldn’t be expected to understand every nuance of running your doctor’s office.

But with doctors, you understand the effects of being treated. With financial advisors, that may not be the case. It’s up to you to explain it to them.

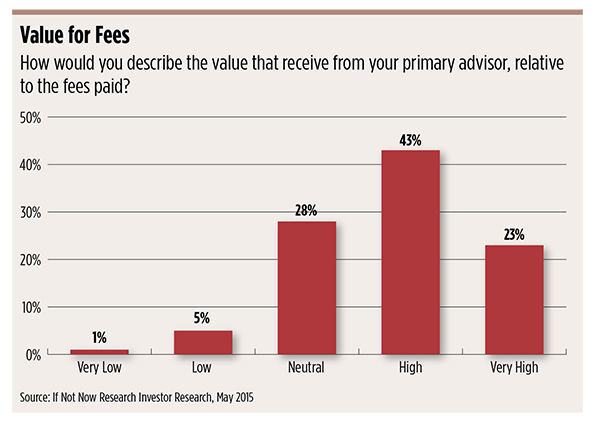

If you haven’t articulated your value to clients recently, or if you’re making the assumption that they like you and trust you and that they’re not worrying about whether you are worth your fee, you may be missing something important. It’s easy to confuse satisfaction and value but they are very different. Note that 60 percent of clients are ‘very satisfied’ with their advisor but only 23 percent say their advisor provides ‘very high’ value relative to the fees paid. If fewer than a quarter of clients say value is ‘very high’ this poses a significant risk.

The reality is that we don’t enhance value by improving service, although that is the default for many advisors. If you contact clients more often, pick the phone up faster when they call or create the ideal performance report you may drive satisfaction but not value. Value is more closely linked to the offer and the relationship; it’s connected to leadership.

A Changing Landscape

With robo advisors such as Wealthfront and Schwab Intelligent Portfolios running TV ads, consumers are regularly hearing messages about low fees. Today only 17 percent of clients said they are familiar with the term ‘robo advisor’ but that will change quickly. It won’t be long before they’re asking themselves what, exactly, they’re getting for their annual 1 percent – or more – of AUM fee.

Robos are changing the marketplace in terms of positioning services and how advisors charge. Consumers want more transparency – both the high-net-worth investor as well as the mass affluent. But as a competitive threat, this is not new. We saw it when Jack Bogle founded Vanguard, with a completely different pricing model.

In a recent study from the FPA’s Research and Practice Institute, 58 percent of advisors said they would integrate robo-technology in some way, and 42 percent say it will play no role in their business. When asked how robo technology will be integrated, respondents spoke about using it as a supplement to the advice they provide, outsourcing investment management to technology providers to focus on the value-add side of the business, creating a segmented service offering and perhaps targeting younger, or cost-conscious, clients.

We’re also experiencing a perfect storm of regulatory interference. From Dodd Frank to the battle between the Securities & Exchange Commission and the Department of Labor over a universal standard of care, new rules are constantly looming over the industry.

A lot of advisors confuse their regulatory model – RIA, broker/dealer, hybrid – with what they actually do, and let the label determine how they get paid. But a business model is not a value proposition. How your firm is compensated is part of your business strategy – but it’s not where your clients perceive your value.

With consumers wanting more transparency, you must consider whether your pricing model will stand up to scrutiny. If not, you should reconsider that model. If most of a client’s investment plan can be handled by a computer algorithm, and your client just needs your help to keep from making bad decisions, perhaps you shouldn’t charge a percentage of assets.

If your value proposition is that you will maximize the client’s investment returns, then ask yourself if you are really providing unique investment acumen – or just marking up someone else’s intellectual capital?

If your real value to your clients is to act as a catalyst to get them to take appropriate action, then it’s essential you communicate that value. Whether you’re minimizing their tax liability, providing a solution for a portfolio overweight in company stock, managing risk, helping with legacy planning, planning for retirement, providing informed guidance on their wish to buy a second home, or – perhaps most important – managing their emotions so they don’t go off the rails financially, your value is real and it’s important that they know what it is and that you charge them accordingly.

So think carefully about what value means, using the words of your clients. We operate in a complex industry that applauds technical expertise. However, when clients think about value they are thinking about impact. Have you helped me feel more confident? Have you helped our family communicate about money more effectively? Have you helped us build a bridge from one generation to the next? The words that clients use to describe your value may not sound as ‘smart’ but they are infinitely more powerful. In fact, they are priceless, which makes discussing fees considerably easier.

Many consumers are confused about what they pay their financial advisors – and they don’t understand the difference between suitability and a fiduciary standard. And while regulations are ostensibly in place to protect consumers, they often prevent the public from getting access to the information they need. The infrastructure of the industry itself tends to hinder transparency.

Eventually your clients, and every other advisor’s clients, will start asking the hard questions. Before they do, you should ask and answer them yourself, then share the answer with your clients soon and often.

Matt Lynch is the Managing Partner of Strategy & Resources, LLC, a financial services consulting firm.

Julie Littlechild is the Founder of If Not Now Research, a research and training firm for advisors.