In the transaction-oriented world of financial services, you can line your walls with articles, books, and CDs teaching you everything you need to know about investing money, reducing taxes, and ensuring suitable cash flow. That is essential knowledge but it is not enough. In the coming years, knowing the art and science of supporting a grieving client will be as essential in your skill set as constructing a risk-appropriate portfolio.

This reality is reflected in the emergence and popularity of robo advisors. If all your clients want is hard data, financial facts, and portfolio balancing, they do not need you. It is all available elsewhere, and at a lower cost. Your unique value proposition lies in your ability to build solid relationships over time. Your clients want a trust-worthy and knowledgeable advisor who "gets" them, who understands what they are going through, who helps them see the long-term, and walks them through the ups and downs of whatever life throws at them.

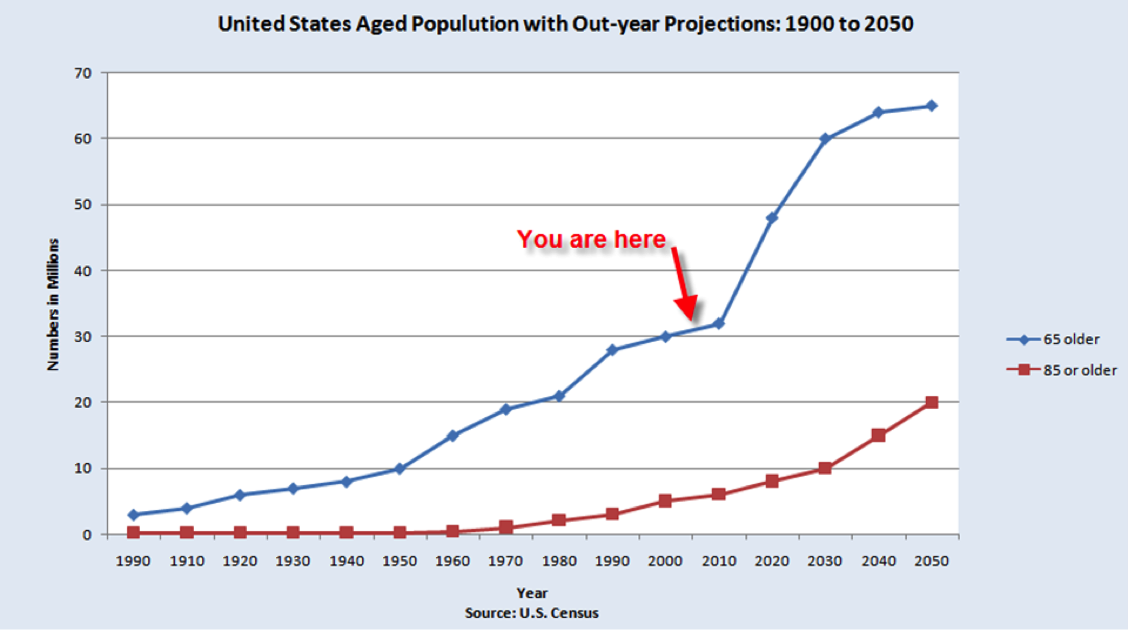

In the coming years, what life will increasingly throw at them is death, divorce, retirement, diminished capacity and other major life transitions. It is inevitable because of our aging population. About 10,000 baby boomers are turning 65 every day in the U.S., and that will continue for the next 15 years.

The reality: We had a baby boom. We're in for a death boom. And we are not prepared, because no one ever teaches you what to do and say when your client is grieving. Yet those skills may define your success going forward.

I know this from personal experience. When I was widowed at a young age, my financial advisor knew how to talk about money and how to invest it with competitive returns, but he had no clue what to say to me about my husband's death. He missed a vital opportunity to solidify my trust and loyalty. Instead, I stayed with him only until I found another advisor who could invest my money with equal competence but who also knew what to say to me. I've heard similar stories from the more than 2,000 grieving people I've worked with in the last two decades. In fact, 70 percent of widows switch financial advisors according to 2011 Spectrem Group research. CEG Worldwide reported that over 95 percent of adult children fire the parent's advisor after receiving their inheritance. Keep the status quo and you could have a lot of assets marching out the door.

Think about your own experience. Few people are taught what to say at the services after a death, so it's tempting either to avoid the services altogether or else we go but all we can offer is things like "I'm so sorry for your loss" or "You have my sympathy." The scenario continues when the widow comes in for her appointment. Were you taught how to act around a person whose spouse died last month? Or three months ago? Or six? If not, you probably avoid mentioning the name of the one who died, stick to business in hopes that emotional topics stay below the surface, and keep tissues close by so you can hand one over immediately should any tears arise. These aren't helpful or supportive practices, yet most advisors simply don't know any better.

A few key principles that we will explore more fully in the coming months:

- Ask good questions. Even before getting down to business, one of the greatest needs of grieving people is to tell the story. Open-ended questions invite that story and allow clients to answer in any way they choose. The answers are healing for your client, while providing you with information that helps you serve them better.

- Keep the focus on them, not on you. A seriously ill client doesn't care about who you know with the same diagnosis. Grieving clients never want to be told you know what they feel, or told how to feel, act, or react. Clients experiencing grief, loss, and transition do not want you to "fix" them.

- Clients need to be prepared ahead of time in financial and non-financial ways. There are many steps you can take to protect your clients and simultaneously protect your firm. Taking these steps also gives you common-sense ways to meet the family and trusted inner circle in ways that position you as the go-to advisor.

- For many clients, a loved one's death (or their own) will come only after a lengthy period of increasing incapacity due to cancer, dementia or illnesses like diabetes, ALS, Parkinson's, COPD or congestive heart failure. They need compassion and understanding as well as protection, preparation and a competent guide through it all.

With a little knowledge, you can learn to talk with and support your clients in difficult times. Increase the chances that you not only keep their business, you generate referrals, extend your reach into the immediate family, and build long-term loyalty and trust. As a side benefit, you gain skills and information that help you in your personal and family life as well.

Learn the skills of grief support, and you set yourself apart from the rest of the field in ways that make a crucial difference in your clients' most difficult times. The goal of this column is to start you on that path. I look forward to our journey.

Amy Florian is the CEO of Corgenius, combining neuroscience and psychology to train financial professions how to build strong relationships with clients through all the losses and transitions of life.