Financial advisors experienced a boom year in 2014, earning record revenues while increasing client assets under management and client retention, according to a new report from PriceMetrix.

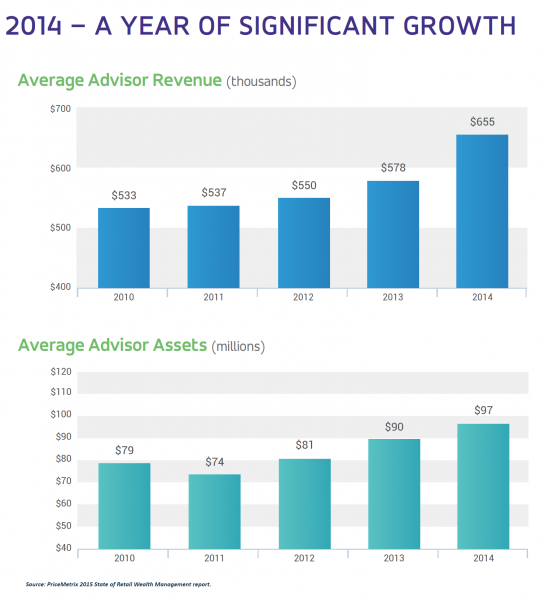

Advisors’ assets under management and revenue have risen every year since 2011, but advisors saw a 13 percent increase to an average of $655,000 in revenue per advisor in 2014, more than double the 5 percent increase seen in 2013. Advisors also experienced an 8 percent gain in assets, with the average advisor managing $97 million in assets, according to PriceMetrix's 2015 State of Retail Wealth report, which draws its information from the company's database of over 7 million retail investors, 500 million transactions and over $3.5 million in investment assets.

“One of the things that was really interesting in 2014 was that production growth outpaced asset growth. When you compare those two, that means the overall productivity rates of revenue over assets actually increased, which is the first time we’ve seen that in a number of years,” said Pat Kennedy, co-founder and chief customer officer for PriceMetrix.

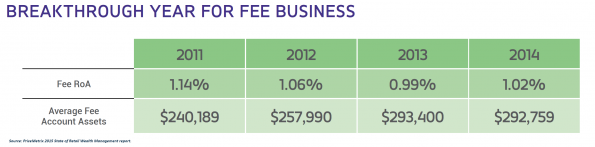

One of the factors contributing to the increased productivity is advisors’ increased fee-based business. The average advisor increased his or her fee-based business from 31 percent of their overall business in 2013 to 35 percent in 2014. By the end of last year, 25 percent of clients were doing at least some fee-based business with their advisor, PriceMetrix found.

Client retention also saw modest improvement in 2014, according to the report. Among clients with more than $250,000 in assets, retention rose from 96.2 percent in 2013 to 96.7 percent in 2014. Among those clients with more than $2 million in assets, retention increased from 97.4 percent to 97.7 percent.

A key factor contributing to that increase could be that yet again, PriceMetrix found that the average number of households served per advisor fell. The average advisor saw their number of clients drop from 156 advisors in 2013 to 150 in 2014.

“We’ve seen this in the past, client retention rates go up when advisors focus on fewer clients,” Kennedy said. “It’s not surprising, but it’s a pretty direct correlation. If there’s a better reason to ‘right-size’ your practice, I’m not sure what it would be.”

Despite the decrease in the average number of households services, Kennedy said there’s little cause for concern.

“We have to ask is it dropping voluntarily or involuntarily?” he said. In this case, because of the high levels of client retention, as well as the continued rise in the average household assets ($628,000), Kennedy said it’s still a positive sign of advisors “right-sizing” their practice, rather than a majority losing key clients. Even 150 clients is a lot, he adds, noting that means advisors spend about 13 hours on average annually per client.

But while most advisors experienced a “fantastic year,” Kennedy said not all advisors shared in the success. PriceMetrix noted that production actually declined 15 percent among the bottom quartile of advisors—leading to a wider gap between the top and bottom producers.

“There’s clearly a separation of the pack happening. There’s evidence that while there’s probably a lot of prosperity ahead, but it may not be enjoyed by all advisors,” Kennedy says.