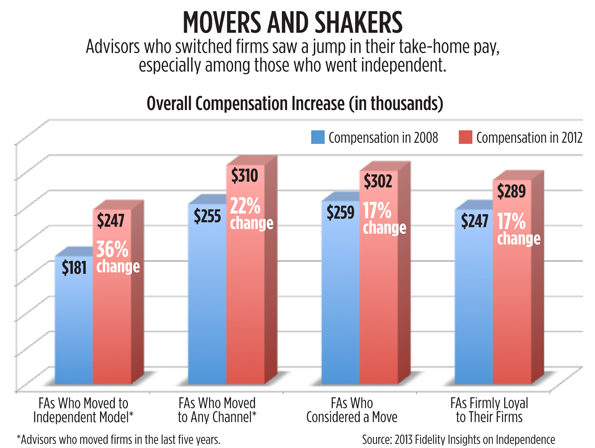

Looking to boost your pay? Try going independent. That's the conclusion of a recent report by Fidelity Investments. Advisors who moved to an independent firm in the last five years—either an independent broker/dealer or RIA—saw their compensation increase 36 percent, according to the survey. That compares to a compensation boost of 17 percent for advisors who stayed put over the same time frame.

Fidelity surveyed 783 advisors from all channels with more than $10 million in assets under management. The firm found that those advisors who moved from a wirehouse or regional brokerage to an independent firm (about 100) had lower compensation on average than advisors who moved to another non-independent firm as well as those who didn’t move at all.

But, the report found, those who went independent saw the largest percentage increase in compensation, boosting their pay 36 percent, compared to a 22 percent increase for all advisors who made a switch regardless of channel. Like those who didn't move at all, advisors who switched to a similar channel increased compensation by 17%.

True, independent advisors typically have higher payouts than other channels because they’re not giving a large cut of their revenue to their broker/dealer, so that could be driving the boost in take-home pay. In the IBD channel, payouts are generally in the 90 percent range, said Alexandra Taussig, senior vice president of marketing for Fidelity Investments.

Of course, Fidelity has a reason to tout the numbers, as the parent company to National Financial and Fidelity Institutional Wealth Services, which provide clearing and custody services for independent broker/dealers and RIAs, respectively.

But the increase in compensation may not account for the incremental costs advisors have to assume when going independent, such as operations, staff and administrative costs, said Tyler Cloherty, associate director at Cerulli Associates.

Fidelity didn’t specifically ask if advisors were factoring in these costs, although the firm asked for “total gross compensation including salary, commissions and fees (before taxes) in 2008 and 2012.”

“When you think about your overall revenue, yeah your payout’s going to be higher, but that’s not the total picture of what you’re bringing home ultimately,” Cloherty said. “Ultimately you’ve got to take the opportunity cost of taking time away from being an advisor to run a business and also the incremental costs in terms of operations are hard to get your arms around.”

For that reason, Cloherty said, it’s difficult to say for sure whether one model is more profitable than another.

Still, when asked, advisors say a big reason they made the move was for higher compensation, Fidelity found. Twenty-nine percent of advisors said they moved for financial reasons, including greater upside in earnings and opportunities to grow their book; meanwhile, 77 percent of them said they were better off financially.

“They’re definitely out there looking for more compensation,” Taussig said.

Independent advisors tend to be more fee-based and work in teams, traits which are tied to having more AUM and higher pay, Taussig said. Cerulli data also found that advisors who use the fee approach have more assets.