Connecticut has the highest number of individuals making over $1 million in income, accounting for 0.63 percent of the state’s tax-paying population, according to a recent study by personal finance website MoneyRates.com. Connecticut was followed by Washington, D.C., where 55 out of every 10,000 taxpayers earn $1 million or more, and New York, with 47 out of every 10,000 taxpayers in this group. Meanwhile, Mississippi had the highest number of low earners, with nearly half of its population making less than $25,000 a year.

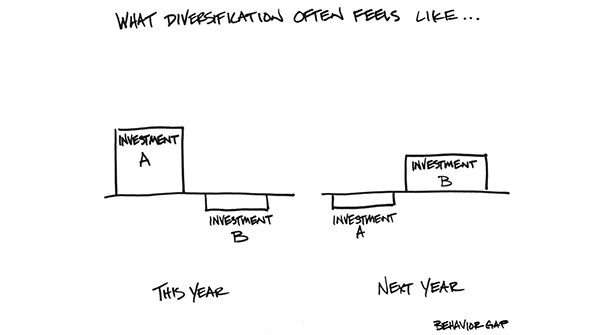

Tadas Viskantas, on his blog Abnormal Returns, has a Q&A with Carl Richards, financial advisor, director of education for the BAM Alliance of advisors, and the guy known for those simple napkin sketches for the New York Times on personal finance topics. Richards’ new book, The One Page Financial Plan, is meant to help that large group of consumers who avoid financial planning out of fear, an inability to navigate the oceans of information available to us as investors, as well as the emotional responses that dictate our thoughts about money. “Not only does it often feel financially complex with all the spreadsheets and calculators, but money also involves navigating complex emotional territory.” Richards' advice? Don't try to be perfect. Financial planning is about making a series of educated guesses that can be adjusted over time.

Historically, April is a good month for Wall Street, all joking aside. In fact, for the Dow, there isn’t a better month on record dating back to 1950, according to the Stock Trader’s Almanac. Since 2006, The DJIA has been up in April nine years in a row with an average tally of 3.1 percent. April is third best month for the S&P 500 and fourth best for the NASDAQ, since 1971. Prior to 1994, the first half of the month used to outperform the second half, but that no longer seems to be the case; "The effect of the April 15 tax deadline appears to be diminished."

When it comes to retirement readiness, Americans are lagging behind, according to findings from a recent study by Voya Financial. Dubbed the Voya Retire Ready Index, the research was designed to show how workers and retirees score on an average basis, while also examining attributes of the highest scorers to learn more about what they do to prepare. According to the study, workers and retirees scored highest on retirement knowledge, but lowest in planning. "The findings reinforce what we know is required to help advance retirement readiness - more individuals need to put their knowledge to action," said James Nichols, head of Retirement Income and Advice Strategy for Voya Financial.

FINRA Fines

The Financial Industry Regulatory Authority fined three broker/dealers on Monday for failing to adequately supervise consolidated reports advisors sent to clients. H. Beck, LaSalle St. Securities, and J.P. Turner & Company paid a collective $700,000 for the violations. According to FINRA, the firms allowed advisors to enter customized values for accounts or investments held away from the firm without providing safeguards to verify the accuracy of these statements.