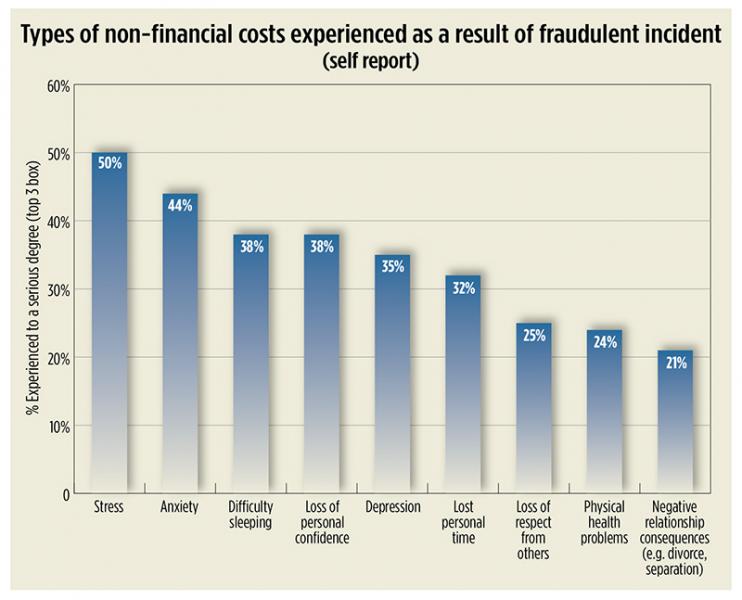

When investors are hit with fraud, it’s not just their wallets that hurt, (although about 9 percent do declare bankruptcy as a result). According to a recent survey by the Financial Industry Regulatory Authority, there's an emotional toll as well, with about two thirds of victims reporting they suffer from severe stress, anxiety, difficulty sleeping and depression.

Almost half of investors blame themselves for the fraud, while over 60 percent feel that they were defrauded because they were too trusting, according to FINRA’s survey of 600 self-reported fraud victims. In conjunction with Applied Research & Consulting, FINRA's data was solicited responses to an online survey in August 2014.

The most commonly cited non-financial costs of fraud were severe stress, followed by anxiety, trouble sleeping and depression.

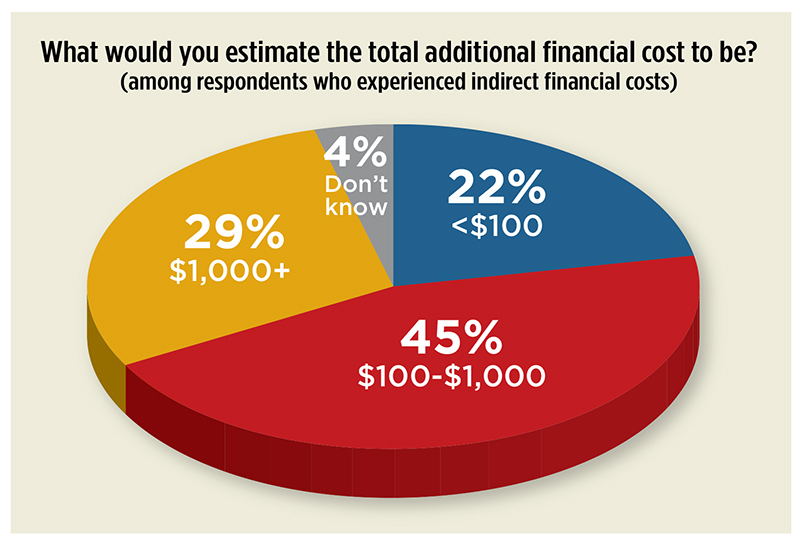

In addition to the self-esteem blow, the fraud interfered with the victim’s ability to pay bills and make ends meet, with a third of fraud victims reporting they suffered more than $1,000 in indirect costs, including legal fees, late fees and bounced checks.

Moreover, about one in 10 victims declared bankruptcy as a result of the fraud, a rate that rose to about 13 percent among investors aged 35 to 54.