More advisors are starting to see the value of using social media. According to a recent survey of over 800 advisors by Putnam Investments, 81 percent of advisors report currently using social media for business, up from 75 percent reported last year. But perhaps more significantly, 79 percent of advisors report acquiring new clients through their use of social, a gain of 13 percentage points from 2014. The average annual asset gain from these clients is about $1.9 million, up from the $1.2 million reported in 2014, the study found. The average profile of an advisor using social media is a 44-year-old at a wirehouse working in the southern or western areas of the U.S. Generally he or she has around 10 years of experience and a book of business worth approximately $80 million. Advisors are usually active on five social networks, the study found.

Can Bon Jovi Save Atlantic City?

A state senator from New Jersey wants to give a boost to Atlantic City, its ailing capital of sleaze, sin and sun, by exempting “A-list” performers from paying income tax for shows performed in the state. David Brunori at The Tax Analysts Blog calls this “the silliest tax proposal of the year” and that it “represents all that is wrong with the way we approach taxes in America.” High taxes on performers is not what is killing Atlantic City, itself the result of copious tax breaks to casino operators. Rather, it’s the proliferation of gambling options up and down the East Coast. But more importantly, who would decide who is an “A-list” performer? “Perhaps there would be a home-state bias,” he says. Whitney Houston, Jon Bon Jovi and Paul Simon would all likely make the cut, as would Bruce Springsteen, no doubt. How about Southside Johnny of the Asbury Jukes? A-list, or no? And what if a foreigner made the cut? Would that violate WTO rules? “The questions are endless,” Brunori says. “It is troubling that politicians look to the tax laws as a panacea for whatever ails society. And the resulting policies are never sound.”

Comedian Lied About Merrill Employment, Dramatic Tower Escape on Sept. 11

A popular comedian has been exposed by The New York Times for lying about his escape from the south tower of the World Trade Center on Sept. 11, 2001, where he has repeatedly claimed he was working on that morning as a Merrill Lynch employee. According to the report, Steve Rannazzisi, best-known for his role as Kevin MacArthur on "The League," has said in interviews that he was working on the 54th floor when the first plane struck the north tower, and that he later fled to the street. The problem: Merrill Lynch has no record of Rannazzisi's employment, and had no offices in either tower. After being confronted with evidence that undermined his account, he acknowledged on Tuesday that his account was fiction. "I was not at the Trade Center on that day," Rannazzisi said in a statement provided by his publicist. "I don't know why I said this. This was inexcusable. I am truly, truly sorry." In a December 2009 podcast interview, Rannazzisi said he had been working at Merrill Lynch for a year and a half as an account manager. He was actually working in Midtown Manhattan that day. Buffalo Wild Wings is currently re-evaluating their relationship with Rannazzisi pending a full review. The comedian was recently signed on as the face of an ad campaign associated with the restaurant.

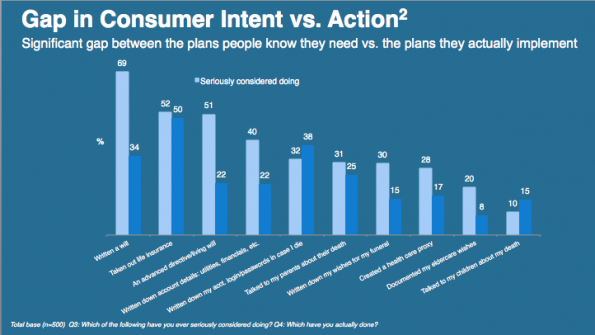

A pair of recent studies commissioned by Everplans demonstrate significant gaps in consumer intent vs action in the realms of estate and eldercare planning. The research, performed by Harris Poll and Ask Your Target Market and surveying a total of 2,500 people, suggests that consumer awareness of the need for end-of-life planning services is fairly high, but a low percentage of respondents actually act on said knowledge. For instance, 69 percent of respondents say that they’ve considered creating a will, yet only 34 percent currently have one in place. 51 percent have thought about creating a living will or advanced healthcare directive, but only 22 percent have one of these documents. And, in the growing field of digital asset protection, although 40 percent have “seriously considered” documenting digital account details for future generations, only 22 percent have actually done so. These numbers indicate that advisors who can find ways to motivate their aging clients to put plans in place stand to benefit greatly.