This weekend Sotheby’s will be auctioning off what it deems the “greatest collections of Americana ever assembled” on Saturday and Sunday in New York. The items are part of a collection assembled by Irvin and Anita Schorsch, the parents of former RCS Capital chairman Nicholas Schorsch. The sale includes Chippendale carved furniture, Delft ceramics, dueling pistols, needlepoint samplers and artwork. In addition to the collection, the family’s historic $2.2 million home, Hidden Glen Farms, in Pennsylvania, is also up for sale. Schorsch’s mother passed away last May.

Rich States Don’t Manage Money Well

You’d think people with money would be better at managing it. But a new study by CreditCards.com shows it’s quite the opposite—at least when you’re using credit scores as a barometer for money management. “People in high-income states often have dinged-up finances,” the website writes. “On the other hand, consumers in low-income states often earn better credit scores than their more-affluent neighbors.” To come up with the list, CreditCards.com compared residents' average credit scores to their median household income. Montana, which has a below-average household income and the 11th best credit score, was ranked the top state for managing money, followed by South Dakota, North Dakota and Maine. Maryland, which has the second-highest household income in the nation and the 31st highest credit score, was the worst performer on the list.

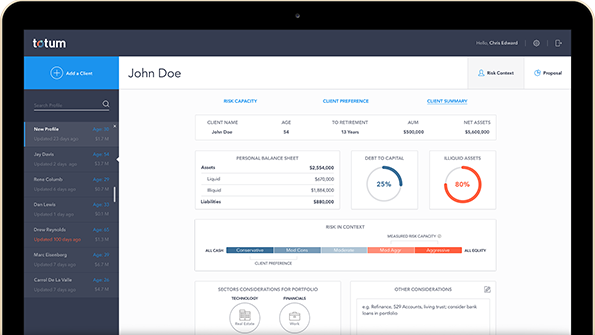

Institutional Tools for Advisors

Min Zhang, a veteran of PIMCO, and Mark Cone, a co-founder and former managing partner of Causway, are hoping their new startup, Totum Wealth, will bring to advisors the tools that pension funds and endowments use to build totally customized portfolios. The company launched its first product, a financial planning program also called Totum, on Thursday. Totum uses what it calls “human capital factors,” like geography, industry concentration, career, health, family, real estate and balance sheet, to analyze a client’s risk and generate a unique portfolio. The company says the software can be used as either a turnkey SaaS application or hosted in-house.

Financial satisfaction among Americans is at its highest level since 2007, according to a new study by the American Institute of Certified Public Accountants. The study, which measures how much financial pleasure and pain consumers are feeling, places satisfaction at 15.9, up 134 percent from a year ago. The index found that while financial pleasure fell slightly, it was nowhere near the sharp drop in financial pain experienced by consumers. Among the things that American's are not worried about: inflation, which saw its component of the financial pain index drop 68 percent during 2015. The study doesn't take into account the significant drop in the stock market during the beginning of 2016, however, CNBC reports.