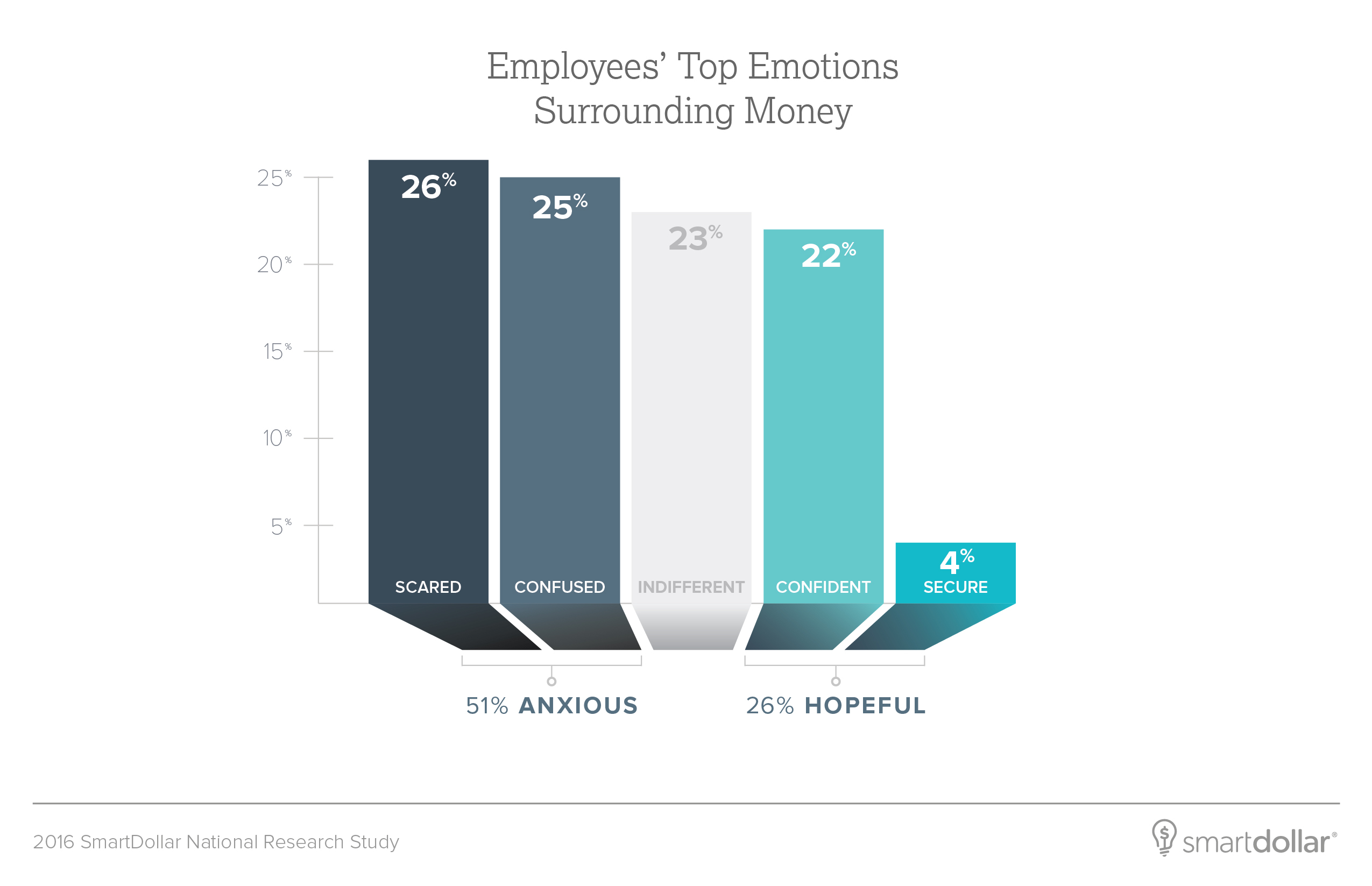

Scared and confused is how Americans feel about handling their personal finances, says a new report by SmartDollar and Ramsey Solutions. While 26 percent say they are scared and 25 percent feel confused about handling money, only 26 percent of Americans feel hopeful about their financial situations. Of the most anxious workers, 65 percent live paycheck to paycheck, 70 percent rarely use a written monthly budget and 70 percent would not be able to cover a $1,000 or more emergency without borrowing. And that's an issue. “Clearly many American workers have reason to be anxious. Failing to budget or maintain an adequate emergency fund, these employees are under constant stress," said Ramsey Solutions Vice President Brian Hamilton of SmartDollar. “The good news is that workers view their employers as a trusted source of financial education. A financial wellness program focused on proven, practical action steps toward lasting behavior change is the solution.”

Fifth Third Bank Names New Family Office Head

Reuben Rashty has been named the new executive director of Fifth Third Bank's family office unit for ultra-wealthy clients. Rashty, a 25-year banking veteran, has been hired away from JPMorgan Chase to become executive director of Chicago-based Mirador Family Wealth Advisors, the Cincinnati Business Courier reports. With offices in Detroit, Grand Rapids, Mich. and Chicago, Mirador targets clients within Fifth Third's 10-state footprint with at least $50 million in net worth. The family office works with those clients on all financial issues, ranging from estate and succession planning for business owners to wealth transfer, investment management, banking services and trust, legal and accounting services. Rashty, who will report to Phil McHugh, the executive vice president and head of Fifth Third Wealth and Asset Management, replaces Glen Johnson, who was managing director and founder of Mirador. Johnson has shifted over to a new leadership role in the bank's wealth division.

Robo advice has gained in popularity in 2016, especially among affluent investors. In the second edition of the “Wealth Management Monitor” from Investing Media Solutions, 63 percent of respondents said they were aware of the term “robo advisor,” a 14 percent increase from a similar study published in February. The study also found that awareness of robo advice was directly correlated to affluence. Seventy-three percent of respondents with more than $1 million in investable assets were familiar with robo advice, and the number jumps to 78 percent among people with $5 million or more.