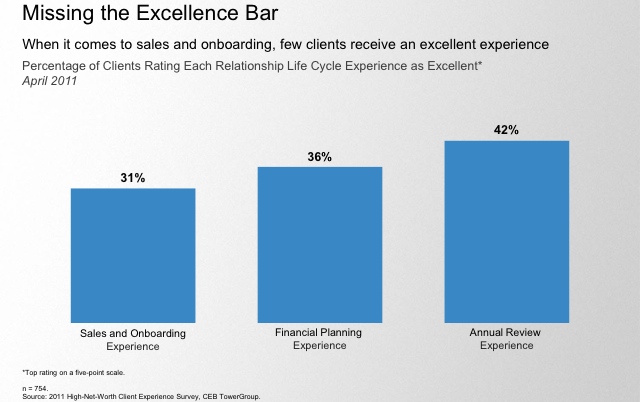

Only three out of ten advisors believe their client onboarding is excellent, according to Darrin Courtney, research director at CEB Tower Group. And with many firms still working with piles of paperwork—10-14 pages of account opening forms, the 4-6 pages of disclosure forms clients need to sign and the few additional forms covering margin and standing instructions—it’s no wonder.

“We sit down with our clients and we start the game of ‘let’s complete these forms. And as you know, if you miss one signature or one piece of data, it gets rejected,” Pershing’s Michael Nesspor told INSITE attendees Thursday, noting that the problems usually mean advisors have to start all over again.

“We sit down with our clients and we start the game of ‘let’s complete these forms. And as you know, if you miss one signature or one piece of data, it gets rejected,” Pershing’s Michael Nesspor told INSITE attendees Thursday, noting that the problems usually mean advisors have to start all over again.

He added that on average, 30 to 40 percent of the basic new account forms are rejected and advisors have to go back to the customer for more information or a signature. For paperwork for more complex accounts dealing with issues such as trusts, the initial rejection rate increases to 50 to 60 percent.

That signature at the end is the most common obstacle. A 2013 CEB bank client survey around showed that 70 percent of clients said the biggest problem they had with opening an account online was that they were sent the paperwork to sign before the account could be opened.

In a paper world, clients have to come into office to manually fill out forms and sign documents in person and it can be frustrating for both he client and advisor. That’s why many firms are moving toward digital onboarding, Courtney says. It’s a streamlined approach where clients can fill out the forms anywhere or work with firms’ back office support over the phone to complete forms and then use an e-signature.

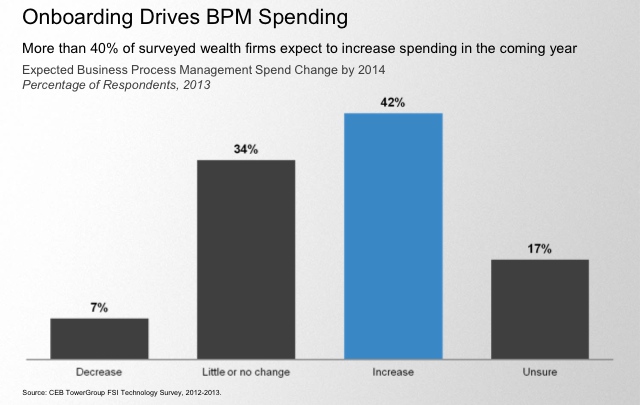

In fact, onboarding is driving business expenses, with 42 percent of firms saying they’re increasing business process management spending this year, according to a CEB survey.

But Courtney says it has to go beyond firms just spending money for the latest technology “It has to be around integrating the work flow, making it easier for the advisor,” he says.

“If they don’t make these investments, they’re putting the firm—and you as an advisor working at those firms—at a tremendous risk,” Courtney says.