This report is one of a series on the adjustments we make to convert GAAP data to economic earnings. This report focuses on an adjustment we make to convert the reported balance sheet assets into invested capital.

Reported assets don’t tell the whole story of the capital invested in a business. Accounting rules provide numerous loopholes that companies can exploit to hide balance sheet issues and obscure the true amount of capital invested in a business.

Converting GAAP data into economic earnings should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

We’ve performed unrivalled due diligence on 5,500 10-Ks every year for the past decade.

Unconsolidated subsidiaries are companies in which the parent company has significant control, usually owning between 20%-50% of the business. Unconsolidated subsidiaries are accounted for using theequity method. Investments in unconsolidated subsidiaries represent an investment of resources from the parent company, and investors therefore have the right to demand a return on that capital.

However, there are situations where poor disclosure forces us to treat unconsolidated subsidiary assets as non-operating and remove them from invested capital. Sometimes, companies bundle their unconsolidated subsidiary income into a non-operating line item. In those cases, we are forced to treat unconsolidated subsidiaries as non-operating to ensure consistent treatment of the asset and the income. If we did not make this adjustment, we would be holding companies accountable for unconsolidated subsidiary assets without measuring the income from those assets in our calculation of ROIC.

For instance, IBM (IBM) had $120 million in assets accounted for under the equity method. IBM bundles the income from these unconsolidated subsidiaries into “other income”, so we have no way of knowing the amount of money IBM made from their equity method investments. Since all “other income” is treated as non-operating, we must treat the unconsolidated assets as non-operating so that the asset and income are treated the same.

Without this adjustment, return on invested capital (ROIC) is distorted by accounting for assets but not income.

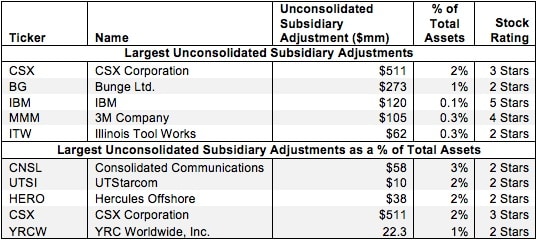

Figure 1 shows the five companies with the largest unconsolidated subsidiary adjustments to invested capital in 2012 and the five companies with the largest unconsolidated subsidiary adjustments as a percent of total assets.

Figure 1: Companies With the Largest Unconsolidated Subsidiary Adjustment in 2012

The companies in Figure 1 are far from the only companies affected by non-operating unconsolidated subsidiaries. We found 40 companies with $2.6 billion in adjustments for 2012 and 726 companies with $77.8 billion in adjustments over the history of our coverage.

As Figure 1 shows, unconsolidated subsidiary assets do not have as big an impact on invested capital as some of our other adjustments. However, adjusting for unconsolidated subsidiaries is still an important step in calculating a company’s true ROIC. For example, CSX Corporation (CSX) has over $511 millionworth of investments in various subsidiaries but no disclosure of the income earned from these subsidiaries. Therefore, we must treat the subsidiary assets as non-operating so that the asset and the income from that asset have the same treatment. The resulting adjustment only impacts ROIC by four tenths of a percentage point. Still, the important points is that we make this adjustment and all others to ensure we deliver the best ROIC in the industry.

There are many instances where the impact of this adjustment is much larger, and there is always the potential of the impact being large for any given company in the future. Better to be diligent and cover this analytical base than to pretend or hope it is not material.

Investors who ignore the impact of unconsolidated subsidiaries on invested capital are holding companies accountable for earning returns on assets to which they don’t have earnings information on. By adjusting invested capital for unconsolidated subsidiaries, one can get a better picture of the value that management is creating for shareholders. Diligence pays.

Sam McBride contributed to this report.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.