Symmetry Partners, a turnkey asset management provider that has $7.4 billion in assets under management and advisement, launched a new microsite Monday with resources to help advisors find, market to and connect with female investors. The “Working With Women Investors” page includes a workbook for advisors, brochures targeted towards women investors, a guide to seminar and event planning, and various communication templates to assist in more personalized client engagement. Symmetry said the firm would also conduct webinars throughout the year featuring leading advisors among female investors and the strategies they are employing to target the demographic. “We’re no longer talking about a niche market, but rather a self-sustaining and formidable segment of the investment landscape that we believe is still drastically under-addressed by the financial advising community as a whole,” said Symmetry’s marketing strategist Connie Yan. “The goal of our program is to help them do just that by placing tangible resources and actionable advice at the fingertips of the advising community.”

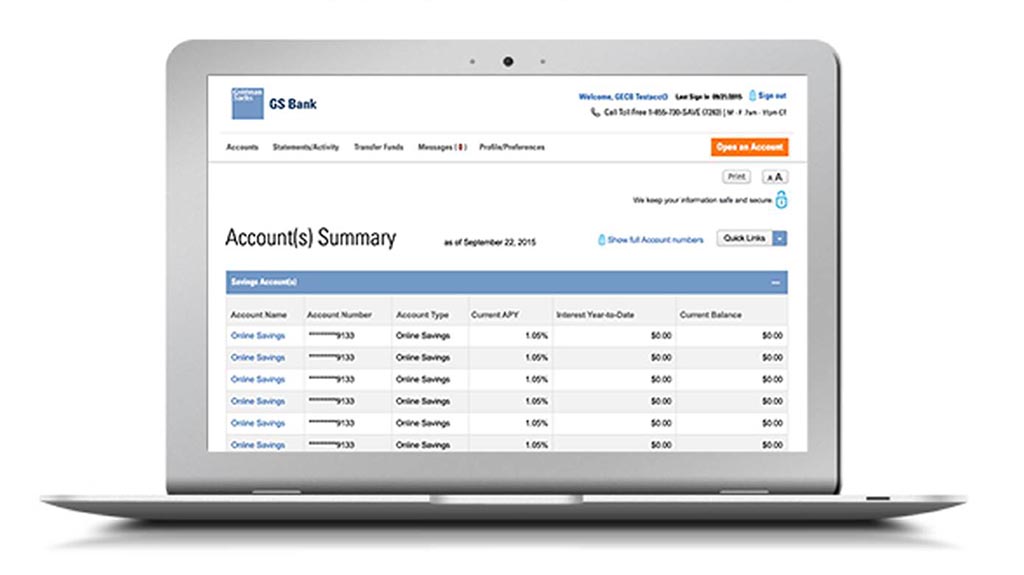

Goldman Sachs Launches Online Bank

Goldman Sachs has launched a online bank for the masses, allowing anyone to open a savings account with no minimum deposit, no transaction fees and a 1.05 percent interest rate, NBC News is reporting. The investment bank made the move as a result of its acquisition of online bank GE Capital and is part of its restructuring due to Dodd-Frank regulations. “This isn’t going to change the banking landscape,” said Greg McBride, chief financial analyst at Bankrate, told NBC. “But it is an effective way [for Goldman Sachs] to bring in low-cost deposits and diversify their funding sources.”

Wells Fargo Advisors Opens in the Great Northwest

Wells Fargo Advisors has opened a new office in the Tri-City area of Washington state. The office, in Kennewick, Wash., is the first new branch for WFA in five years, according to the Tri-City Herald. It opened last week with three advisors, with plans to grow it to 15. WFA's nearby Spokane office serves clients in Eastern Washington, Idaho and Montana and manages more than $2 billion in assets, including retirement savings, stocks and bonds. Wells Fargo Advisors has no upper or lower limit on assets, focusing on households with $250,000 in net assets, including home equity.