A surprising number of millennials have fallen victim to some sort of financial abuse, or "infidelity," perpetrated by their significant other, according to a new study by CentSai, an online community dedicated to educating the younger generation about finance. CentSai defines financial abuse and infidelity as tactics used to gain power and control in a relationship by limiting a partner's access to assets or hiding assets (or liabilities) from a partner who believes all finances are shared. According to the study, one-third of millennials have experienced this kind of situation. Men were most likely to be the perpetrators, but also made up more than half of the self-reported victims. Three percent of the alleged perpetrators faced legal action, and two-thirds of the millennials surveyed said they wanted banks to do more to help victims of financial abuse.

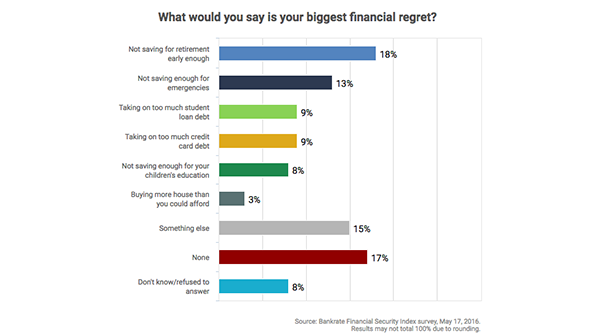

Got Regrets? Not Saving for Retirement Is One

Three-quarters of Americans say they have financial regrets, with not saving for retirement early enough being the biggest one, according to a new BankRate.com survey. The report states that 18 percent of Americans regretted their lack of retirement saving, followed by 13 percent regretting not saving for emergencies and 9 percent for taking on too much credit card debt. The amount of regret increases with age, with up to 27 percent of senior citizens wishing they start saving for their golden years earlier. Millennials, however, listed student loan debt and lack of emergency savings as their biggest financial regrets.

Just because tax season is over doesn’t mean that you’ve heard the last of tax scammers. Recently, the IRS is seeing an increase in state tax fraud specifically targeting businesses and entrepreneurs. According to Forbes, such scams are actually easier for fraudsters to perpetrate for several reasons. States, as a matter of law, maintain a master public database of companies incorporated and registered within them, including legal business name, contact name and mailing address. This is effectively a list of potential victims for scammers. And, since most businesses want to avoid any disruption from a potential tax lien, they’re inclined to pay penalties first and ask questions later. Finally, the line between official and unofficial is already blurred in certain states, since some actually employ private debt collectors who may contact citizens directly.