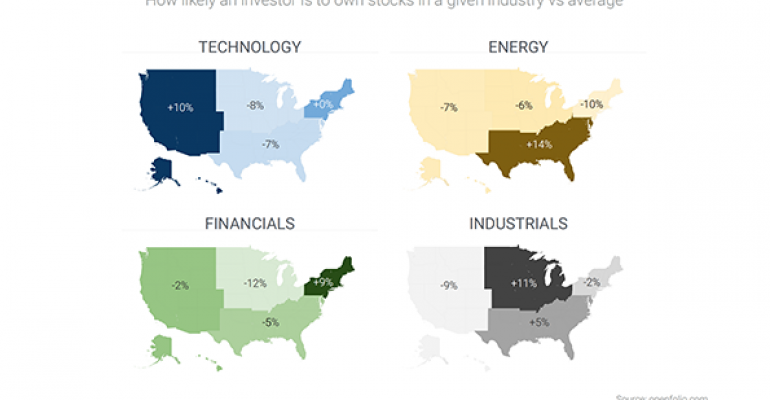

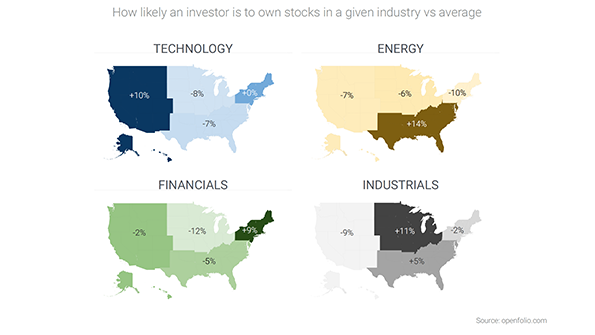

When it comes to investing, many people think regionally, according to research compiled by Openfolio. Investors on the West Coast are 20 percent more likely to own technology stocks like Apple and Facebook, while those in the southern U.S. are bigger investors in energy companies like Exxon Mobile and Chevron. In the Midwest, investors are 22 percent more likely to purchase stock in industrial companies such as GE and machinery manufacturer Caterpillar Inc. Those on the East Coast are 23 percent more likely to put their money in financial corporations like Bank of America and Wells Fargo. But investors’ interest in healthcare companies cuts across all regions.

TD Ameritrade is the latest financial services firm to have a presence on the Apple Watch this week, joining Pershing, Fidelity and Openfolio. Investors can now view stock summaries, major indices and customized stock lists on their wrist. TD also announced that an Apple Watch version of “Mobile Trader,” its app for trading stocks and moving money, will launch in the fall.

AssetMark Adds $1.75 Billion TAMP

AssetMark has acquired the assets of Clark Capital Management Group, a turnkey asset management program in Philadelphia. Clark, which has $1.75 billion in assets on its TAMP platform and serves about 670 advisors, will join AssetMark’s platform as a third-party strategist. The acquisition will give AssetMark’s advisors access to Clark Capital’s ETF strategies, separately managed accounts and Personalized Unified Managed Account (PUMA) service. Once the transaction closes, AssetMark will have about $27 billion in total assets.

As the economy recovers, Americans are sleeping a bit better, but a huge percentage are still losing sleep over financial stress, according to CreditCards.com. A national poll commissioned by the website found that 62 percent of adults are losing sleep over at least one financial problem, down from 69 percent in June 2009. Financial concerns that are causing Americans to lose sleep include saving enough money for retirement, educational expenses, health care bills, mortgage and rent bills and credit card debt. To gather the data, Princeton Survey Research Associates conducted telephone interviews with over 1,000 people.