The RIA community has been relatively quiet in the face of the Department of Labor’s proposed fiduciary rule, many saying that regulators are just catching up to what they’re already doing with clients.

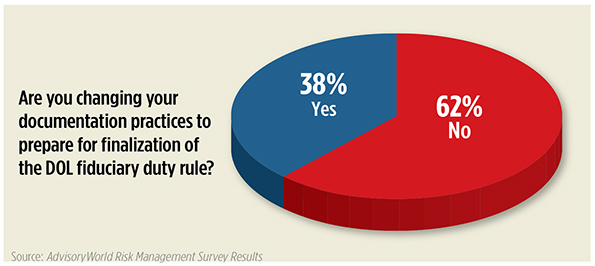

Almost two thirds of these independent advisors say they’re not changing their documentation processes in anticipation of the proposed rule’s implementation, according to a recent flash poll conducted by AdvisoryWorld of 242 of its advisory clients.

The investment software provider surveyed independent advisors who operate both fee-only and hybrid practices across the U.S., with practices ranging above $1 billion in assets.

Additionally, 68 percent of advisors surveyed said that the recent regulatory moves have had minimal or no impact on their risk management processes.

And while it may be true that fee-only advisors may not feel any effects of the proposed rule, hybrid advisors may have to follow some of its mandates. David Bellaire, FSI’s executive vice president and general counsel, noted earlier this month that if advisors working at either a b/d or an RIA provide conflicted advice or differential compensation, they would be required to comply with the procedures to disclose those exemptions.

But for now, advisors on the independent side of the aisle seem to be content wait and see what comes about before taking any definitive steps.