This report is one of a series on the adjustments we make to convert GAAP data to economic earnings.

Reported earnings don’t tell the whole story of a company’s profits. They are based on accountingrules designed for debt investors, not equity investors, and are manipulated by companies to manage earnings. Only economic earnings provide a complete and unadulterated measure of profitability.

Converting GAAP data into economic earnings should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

We’ve performed unrivalled due diligence on 5,500 10-Ks every year for the past decade.

Operating leases are a form of off-balance sheet debt. Two companies with identical operations would have very different financial statements if one funds asset purchases with debt while the other utilized operating leases.

The company that borrowed money to purchase assets would show the value of the debt and the asset on its balance sheet. On its income statement, there would be interest expense and depreciation related to the purchased asset. In contrast, operating leases accounting requires no record of debt or the value of the leased asset on a company’s balance sheet. The only accounting impact is the rental expense on net income.

Rental expenses do not receive their own line item on the income statement. Without careful research in the footnotes, investors would never know the income statement included rental expenses from operating leases.

Our models reverse the distorting effect of operating lease accounting and makes the financials of the two companies comparable. First, we deduct the implied interest expense related to operating leases from net operating profit after tax (NOPAT). This adjustment ensures the NOPAT of the two companies is comparable. NOPAT is an unlevered measure of profit and excludes financing costs. The second adjustment is to put the operating lease debt back on the balance sheet so the two companies balance sheets are comparable. The balance sheet portion of this adjustment will be covered in a separate report.

These adjustments essentially convert all operating leases into on-balance sheet debt to make the financials of companies with differing accounting methods comparable. This conversion gives us a more accurate view of the core operating profitability of businesses.

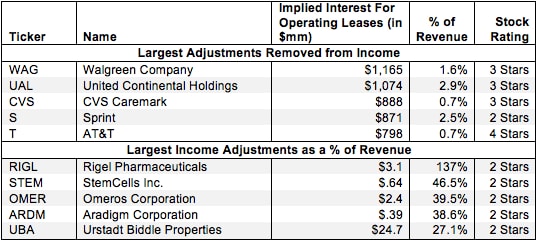

Figure 1 shows the five companies with the largest amounts (gross value and as a % of revenue) of implied interest from operating leases adjusted out of NOPAT for 2012.

Figure 1: Largest Implicit Interest Expense Removed from NOPAT in 2012

Sources: New Constructs, LLC and company filings

Note: Figure 1 excludes companies whose 2012 revenues were less than$1 million

Sources: New Constructs, LLC and company filings

Note: Figure 1 excludes companies whose 2012 revenues were less than$1 million

Though the removal of implied interest expense increases NOPAT relative to GAAP earnings, it does not always mean the company’s stock will earn a favorable rating. For instance, all five of the companies in Figure 1 with the highest levels of adjustments as a % of revenue earn a Dangerous (2-star) rating. And despite our removal of large amounts of income, four of the five companies with the highest amount of implied interest expense as a % of revenue still had a negative NOPAT in 2012.

In other cases, implied interest expenses can artificially deflate reported earnings and disguise the true profitability of a business. Case in point: United Continental Holdings (UAL), had a total of $1.1 billion in implied interest expenses in 2012 due to aircraft and airport property leases. Removing this implied interest expense (among other adjustments made to net income) increased United Continental’s NOPAT to $2.6 billion versus its GAAP losses of $723 million in 2012. At the same time, we increase UAL’s invested capital with $11.6 billion in off balance sheet debt related to the operating leases. The conversion of operating leases to on-balance sheet debt does not universally make a companies ROIC look better. It usually makes it worse.

Investors only looking at reported earnings see a distorted view of UAL’s financials. Converting the operating leases into on-balance sheet debt results in a fairer assessment of the company’s financials. Diligence pays.

Sam McBride and André Rouillard contributed to this report.

Disclosure: David Trainer, Sam McBride and André Rouillard receive no compensation to write about any specific stock, sector, or theme.