I recommend investors buy stock in Scripp Networks Interactive (SNI) before Mr. Buffett buys the whole company.

SNI is a modern-day example of the media/publishing companies for which Mr. Buffett has shown a long-standing interest. His interest in media/publishing stocks is grounded in the superior economic earnings these businesses can achieve. And SNI, with a 21% return on invested capital (ROIC), exhibits the kind of scale that Mr. Buffett knows leads to superior economic earnings.

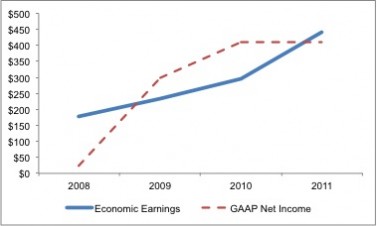

In 2011, the company’s economic earnings grew nearly 50% to over $440 million compared to less than 1% growth in accounting earnings to $412 million. Figure 1 below has the details. Those are impressive economics while the accounting results are just so-so. The economic earnings are what matters, just ask Mr. Buffett.

Figure 1: Economic Earnings Are Higher than GAAP Earnings

SNI’s impressive economics come from selling advertisers access to large audiences of people interested in a narrowly-defined topic. In other words, SNI helps advertisers target market to the specific people they want to reach.

SNI developed this offering by building authority around very specific marketing demographics that are desirable to advertisers. For example, SNI’s portfolio of lifestyle media assets focuses on specifics, such as cooking (The Food Network), travel (The Travel Channel) and country music (Great American Country channel). To deepen the viewing experience and build more authority around the topics, the company also offers websites that are associated with the aforementioned television brands.

One of the smartest parts of SNI’s strategy is the topics they chose. Creating content for the cooking and travel networks is rather low-cost compared to the costs of fancy car chases and stunts that dominate other television channels. In addition, both topics are rich and can produce nearly endless interesting content without having to invent any new ideas or story lines. You do not need a team of high-priced writers to create a show on how to bake cookies. It is like reality TV without the controversy and ridiculousness.

To summarize, SNI has cornered the market on providing advertisers access to people interested in the few universally enjoyable activities on earth: cooking, travel and music.

Now a great business is interesting to Mr. Buffett only if it is cheap – and SNI’s stock is cheap.

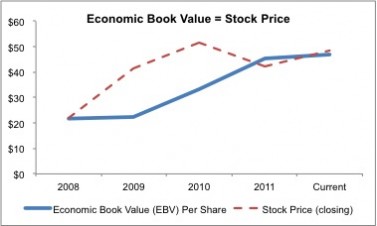

At ~$49/share, the current valuation of the stock implies the company’s profits will hardly grow from current levels. Per Figure 2, the stock price almost equals the company’s economic book value and implies the company will generate very little profit growth above current levels over the rest of its life. Those are low expectations.

Figure 2: No Expectations for Profit Growth In Current Valuation

If the company grows after-tax cash flow (NOPAT) at 5% annually for 5 years, the stock is worth $60/share. If it does 10% for 5 years, the stock is worth $75/share. Compared to the 27% compounded annual NOPAT growth the company has achieved since 2008, those are low expectations.

The combination of a strong economic earnings and a cheap valuation earn SNI my Very Attractive rating. I recommend investors stock up on Scripps.

As mentioned above, I also think the stock is on Warren Buffett’s radar. The company’s business has great economics, strong barriers to entry and a cheap valuation. In addition, the company is based in Knoxville, TN – very near the location of Clayton Homes, which Buffett bought in 2003.

The only fund that allocates more than 3% to SNI and gets an Attractive rating is Royce Fund: Royce Special Equity Multi-Cap Fund (RSEMX) and (RSMCX). I would not recommend any other funds that hold SNI.

My ratings and reports on 7400+ funds are available on my free fund screener. Ratings on all 3000 stocks I cover are here.

Disclosure: I receive no compensation to write about any specific stock, sector or theme.