It seems that if you want the best-performing portfolio, along with a croissant, head to France. According to analysis performed by Natixis Global Asset Management, portfolios from France had an average gain of 7.6 percent. Meanwhile U.S. portfolios generated a loss of 0.9 percent. Natixis found the variations between global portfolios were due to regional differences in construction, as well as varying performances in international markets. In this case, French investors’ portfolios were strengthened by higher allocations in European equities that outperformed, as well as a stronger stake in risk-managed investments. And while U.S. portfolios were not the best performing, they did beat the Dow Jones (-1.21 percent) and the average retail investor’s portfolio (-3.10 percent). Natixis reviewed 855 model portfolios in the moderate risk category from financial advisors and other professionals from France, Italy, Latin America, Singapore, Spain, the United Kingdom and the U.S.

Krawcheck Joins Board of Blockchain Startup

Sallie Krawcheck, the former head of Merrill Lynch and chair of Ellevate Network, has joined the board of Digital Asset Holdings, a developer of a financial services blockchain, the technology that underpins digital currencies like bitcoin. Digital Asset recently raised $60 million in its latest round of funding from a group of investors including Broadridge Financial Solutions, Citi, J.P. Morgan, Goldman Sachs and IBM. The startup announced it would add to its board of directors as part of the fundraising round. “Digital Asset sits at the apex of finance and technology, uniquely positioning them to realize the promise of this new innovation, and I’m delighted to be able to contribute to the firm’s next phase of success,” Krawcheck said.

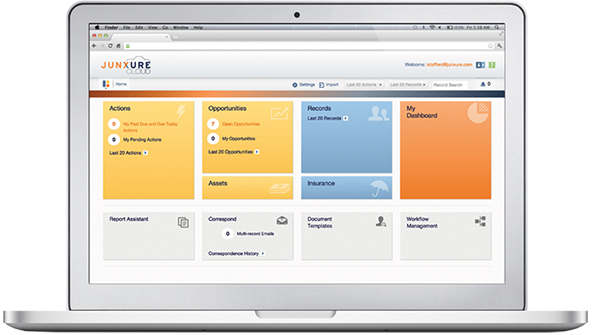

The National Association of Insurance and Financial Advisors announced a new partnership that gives its 43,000 members exclusive discounts and benefits on Junxure’s Cloud CRM technology. NAIFA CEO Kevin Mayeux said technology is more important than ever for insurance and financial advisors, and said Junxure’s “leading edge” CRM will help them in a changing environment. He added that Junxure’s goal of helping advisors meet client expectations aligns with NAIFA’s mission to protect, educate and promote the ethical conduct of its members.

OMG! A client just texted you! What to do next? After translating the endless abbreviations and emojis, that is. Reply? But you can't, legally speaking. Call? If the client had time to talk, they would have. Ignore them? That's just rude. Hence the dilemma facing financial advisors these days as client communication shifts past the phone, email and social media into more immediate forms of contact. The concerns, of course, are meeting basic archiving requirements and other financial and communications rules, as well as ensuring that customers "opt in" to receive text messages and screening to make sure promises of future performance are not being made through text, writes Renee Caruthers for FierceFinancialIT. Hearsay Social has been working with firms on this, according to firm founder and COO Steve Garrity, helping firms develop messaging apps to let advisors communicate with clients with all the proper procedures and compliance intact.