Conventional wisdom holds that households with financial plans tend to fiscally outperform those without. I’ve been skeptical of that view, believing a kind of selection bias is at work: Households with financial plans are often wealthier in the first place.

So it’s interesting to see data released today by the CFP Board of Standards and the Consumer Federation of America that suggests households that plan actually enjoy a sunnier outlook over non-planner households with higher income.

The 2012 Household Financial Planning Survey polled about 1,500 households last May on their attitudes about their financial health, and segmented those results by those who have comprehensive financial plans and those who don’t.

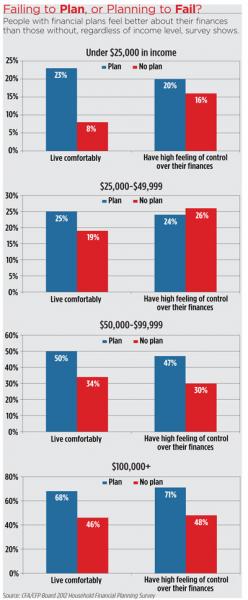

It’s a little bit like reading those surveys in the consumer health magazines that ask people who exercise regularly how optimistic they are about life, etc. Fifty-two percent of planners feel “very confident” about managing their money, compared to 32 percent of non-planners; 48 percent of planners “live comfortably,” compared to 22 percent of non-planners.

The survey found that the trend held true regardless of income. In fact, the share of planners in the $50,000 to $99,999 income bracket who said they “live comfortably" actually edged out those non-planners in the $100,000+ income bracket who said so: 50 percent for the former, compared to 46 percent for the latter. (See right.)

The bad news: only 31 percent of households in the survey have a comprehensive financial plan (defined for the survey as a document that covers savings and investments, planning for retirement, education, emergencies and major purchases, and other financial goals and insurance needs.)

It won’t come as a surprise to advisors that issues of trust are still uppermost in the minds of investors. Fifty-five percent of respondents agreed that “it’s hard for me to know who to trust for financial advice;” another 55 percent said, “I’m worried about losing my money if I invest it.”