Are these your clients? | Copyright Joe Raedle, Getty Images

Take a look at your clients. Are they fat? In good shape? Now look at their portfolios. See any correlation? According to a new study performed by TD Bank, the more physically fit someone is, the more financially sound they are, Catey Hill writes on Marketwatch. And, based on the study, Americans are struggling in the wallet as well as the waistline. Only one-third of Americans are satisfied with their financial health, while among those who consider themselves physically healthy, the number jumps to 65 percent. The takeaway? Have a plan to tackle both your physical and financial health.

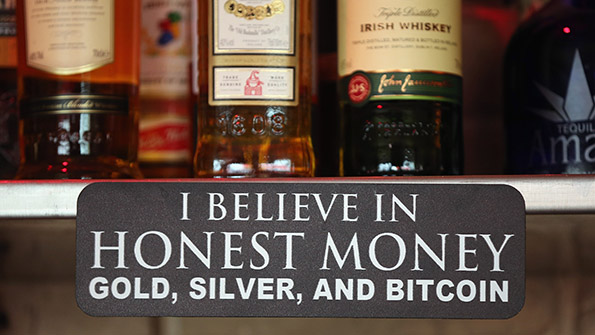

To the moon ... | Copyright Sean Gallup, Getty Images

To the moon ... | Copyright Sean Gallup, Getty Images

Lunar, the Bitcoin exchange run by Coinbase, opened on Monday with $106 million in funding and support by the New York Stock Exchange and others. The exchange also has regulatory backing of half of the states in the U.S., giving it the credibility that other exchanges, most notably the now-defunct Mt. Gox, failed to gain.

It's a good time to be in the snow removal business | Copyright Darren McCollester, Getty Images

It's a good time to be in the snow removal business | Copyright Darren McCollester, Getty Images

Looking for some snowmageddon-related stocks to keep an eye on while hunkering down? CNN Money has highlighted four companies that could benefit from the Blizzard of 2015. They are: Generac (GRAC), which sells generators; Douglas Dynamics (PLOW), a maker of snow plows; PowerSecure International (POWR), which offers smart grid monitoring and backup power services to utilities; and Compass Minerals, a maker of de-icing salts. One caveat: Only Douglas Dynamics turned a profit in 2014, even with last year's snowy first quarter.

All's quiet here. | Copyright Chris Hondros, Getty Images

All's quiet here. | Copyright Chris Hondros, Getty Images

As the first major blizzard of 2015 hammers the northeast, a report from TheStreet indicates that the storm could result in $16 billion worth of lost economic output. Despite the large number, a good chunk of that lost output will be made up for in the coming weeks, and there shouldn't be a significant impact on first quarter U.S. GDP.