The year 2016 started with a bang with the Dow dropping nearly 500 points on Monday. Expect more of these kind of big swings to continue throughout the year, Allianz's chief economic adviser, Mohamed El-Erian, told CNBC. El Erian says that a divergence in monetary policy will set the tone for 2016, specifically the Federal Reserve's tightening and raising interest rates amid easing policies from central banks in Europe and Asia. He expects the Fed to raise rates twice this year, as opposed to four gradual hikes. "This year is going to be all about exploiting volatility on the way up and the way down," he said.

First Day Jitters or Something More?

The Dow Jones Industrial Average plunged more than 450 points at its worst during the first day of trading for 2016. The S&P 500 and NASDAQ suffered as well as traders absorbed the news that China's economy contracted at the end of 2015, sending markets there, already on the decline in recent months, reeling further. Yet January is typically a tough month for the markets, particularly in recent years, and it tends to bounce back, writes Reformed Broker Joshua Brown. For example, the S&P 500 finished the month of January down about 3.5 percent in 2014 and 2015, yet the two-year annualized return was roughly 6 percent, he says on his Reformed Broker blog. But Brown points out that the poor outings in 2014 and 2015 were because of profit-taking measures used to harvest the outsized gains made in the previous years. That’s not the case this time around. “This one feels more like it’s fear-driven than the other two. Strap in,” Brown writes.

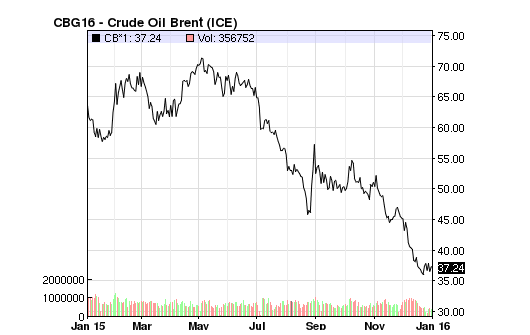

The commodities market had little to celebrate in 2015, with 22 of 24 commodities down for the year, according to Jodie Gunzberg, global head of commodities and real assets at S&P Dow Jones Indices. Twenty of the 22 lost more than 10 percent. Cocoa and cotton were the only commodities to post positive returns, up 9.6 percent and 3 percent, respectively. Brent Crude was down 45.7 percent last year, the most of any single commodity, Gunzberg says. One concern is that commodities, typically a diversification from equities, are becoming more correlated to the stock market; in fact, the correlation between the two asset classes more than quadrupled since July.

Charles Schwab kicked off 2016 by adding two new providers – John Hancock Investments and Deutsche Asset Management – and 14 new exchange traded funds to its ETF OneSource program. John Hancock added six strategic beta ETFs and Deutsche Bank added five currency-edged ETFs and one fixed income ETF. Guggenheim Investments also added two fixed income ETFs, bringing the total number of ETFs available on OneSource to 226 from 16 different providers. The program, which will be three years old in February, has $44 billion in assets under management.