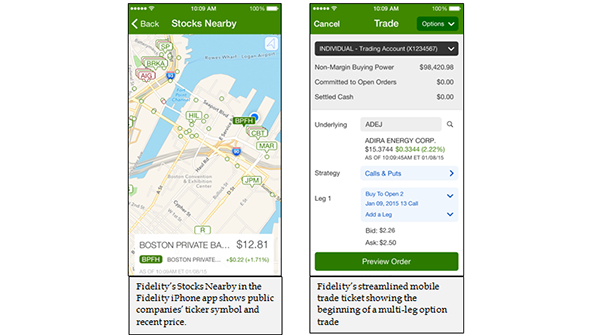

Ever walk by a new store that’s crowded with customers and thought, “I bet that would be a great company to invest in?” Well, now there’s an app for that. Fidelity Investments introduced the new Stocks Nearby iPhone app on Monday, which uses the iPhone’s location abilities to pull ticker symbols and information on public companies near the user. Investors can buy, sell and trade stocks, options, mutual funds and ETFs directly through the app.

The Hulbert Financial Digest found that the stock market might be getting even more difficult to beat. Only 15.6 percent of advisors outperformed the stock market, as measured by the Wilshire 5000 Index, down from 33.1 percent in 2010. Lawrence G. Tint, the chairman of Quantal International and former U.S. CEO of Barclays Global Investors, says investing in an index fund is the best way to earn returns.

Remember when everyone wanted to learn to be a day trader? They're back. "Baby bulls" are flooding into classrooms to learn the basics of investing. Why? Retail investors, riding high after a few years of extraordinary returns, have been the most heavily invested in stocks since June 2007 and are holding less cash than at any time since 2000, according to American Association of Individual Investors. Cashing in on this trend, the Online Trading Academy is looking to double classroom space in its lower Manhattan office where novice investors can learn the basics. But at $60,000 for advanced-level classes, savvy investors may want to heed the warning of several experts who predict that the market is "fully priced."

What was Your First Investment?

Everyone needs to start somewhere, and usually, it's pretty small. Take Jeff Rose of Good Financial Cents, who got started when he didn't even know what a mutual fund was. Rose asked 50 financial experts to share their first investments. "Reformed Broker" Josh Brown admitted that his first investment was with the cable company Cablevision; Gen Y Planning's Sophia Bera took $500 she made acting in a play and opened a Roth IRA.