The small-cap value style ranks last out of the twelve fund styles as detailed in my style roadmap. It gets my Dangerous rating, which is based on aggregation of ratings of 16 ETFs and 309 mutual funds in the small-cap value style as of May 2, 2012. Reports on the best & worst ETFs and mutual funds in every sector and style are on my blog.

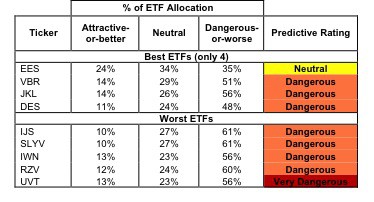

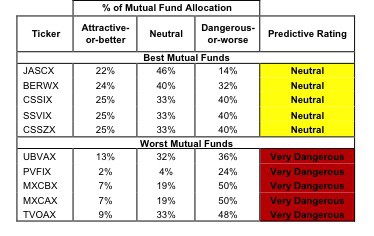

Figure 1 ranks from best to worst the nine small-cap value ETFs that meet our liquidity standards and Figure 2 shows the five best and worst-rated small-cap value mutual funds. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the small-cap value style, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings. My fund rating methodology is detailed here.

Investors should not buy any small-cap value ETFs or mutual funds because none get an Attractive-or-better rating. If you must have exposure to this style, you should buy a basket of Attractive-or-better rated stocks and avoid paying undeserved fund fees. Active management has a long history of not paying off.

Figure 1: ETFs with the Best & Worst Ratings – Top 5 (where available)

* Best ETFs exclude ETFs with less NAV’s less than 100 million.

Sources: New Constructs, LLC and company filings

Two ETFs are excluded from Figure 1 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards. See ratings and reports on these two ETFs on my ETF screener.

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

* Best mutual funds exclude funds with NAV’s less than 100 million.

Sources: New Constructs, LLC and company filings

WisdomTree SmallCap Earnings Fund [s: EES] is my top-rated small-cap value ETF and James Advantage Funds: James Small Cap Fund [s: JASCX] is my top-rated small-cap value mutual fund. Both funds earn my Neutral rating.

ProShares Ultra Russell2000 Value [s: UVT] is my worst-rated small-cap value ETF and Touchstone Funds Group Trust: Touchstone Small Cap Value Fund [s: TVOAX] is my worst-rated small-cap value mutual fund. Both earn my Very Dangerous rating.

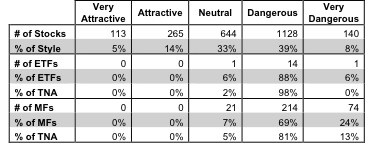

Figure 3 shows that 378 out of the 2290 stocks (over 19% of the total net assets) held by small-cap value ETFs and mutual funds get an Attractive-or-better rating. However, none of the 16 small-cap value ETFs and none of the 309 small-cap value mutual funds get an Attractive-or-better rating.

The takeaways are: mutual fund managers allocate too much capital to low-quality stocks and small-cap value ETFs hold poor quality stocks.

Figure 3: Small-cap Value Style Landscape For ETFs, Mutual Funds & Stocks

Sources: New Constructs, LLC and company filings

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Investors need to tread carefully when considering small-cap value ETFs and mutual funds, as none of the ETFs or mutual funds in the small-cap value style allocate enough value to Attractive-or-better-rated stocks to earn an Attractive rating. Focus on individual stocks instead.

Bridgepoint Education, Inc. [s: BPI] is one of my favorite stocks held by small-cap value ETFs and mutual funds and earns my Very Attractive rating. BPI’s business model of affordable tuition and easy online access has been very successful, generating a current return on invested capital (ROIC) of 75%, better than 99% of Russell 3000 companies. For the entirety of its three-year history as a publically traded company, BPI has consistently generated an ROIC above 35%. BPI’s current stock price of $20.15 implies that the company’s after-tax profits (NOPAT) will permanently decrease by over 60%. With management’s history of superior performance, I see little downside risk with a lot of upside potential.

Healthcare Realty Trust, Inc. [s: HR] is one of my least favorite stocks held by small-cap value ETFs and mutual funds and earns my Very Dangerous rating. HR is a perennial value destroyer. The company has generated negative economic earnings in all 14 years I have under coverage, back to at least 1998. HR’s current 0% return on invested capital (ROIC) puts it in the bottom quintile of Russell 3000 companies. HR’s focus on owning outpatient facilities near hospitals has not generated the kind of returns to justify the risk of investing in the stock.

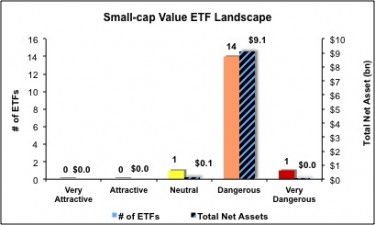

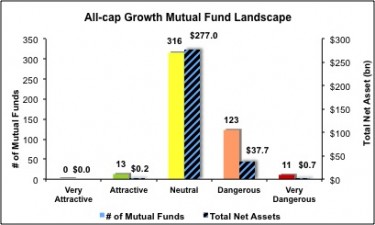

Figures 4 and 5 show the rating landscape of all small-cap value ETFs and mutual funds.

Our style roadmap report ranks all styles and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst Funds

Figure 5: Separating the Best Mutual Funds From the Worst Funds

Review my full list of ratings and rankings along with free reports on all 16 ETFs and 309 mutual funds in the small-cap value style.

Disclosure: I own BPI. I receive no compensation to write about any specific stock, sector, style or theme.