The large-cap growth style ranks second out of the twelve fund styles as detailed in my style roadmap. It gets my Neutral rating, which is based on aggregation of ratings of 26 ETFs and 754 mutual funds in the large-cap growth style as of April 23, 2012. Reports on the best & worst ETFs and mutual funds in every sector and style are on my blog.

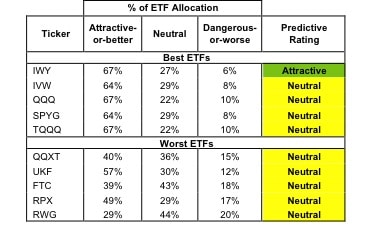

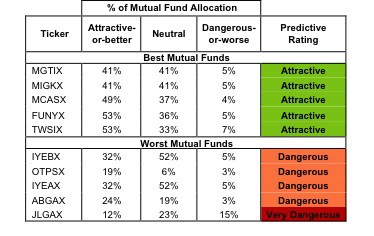

Figures 1 and 2 show the five best and worst-rated ETFs and mutual funds in the style. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the large-cap growth style, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings.

Investors seeking exposure to the large-cap blend style should buy one of the Attractive-or-better rated ETFs or mutual funds from Figures 1 and 2.

See ratings and reports on all ETFs and mutual funds in this style on my free mutual fund and ETF screener.

Figure 1: ETFs with the Best & Worst Ratings – Top 5

* Best ETFs exclude ETFs with less NAV’s less than 100 million.

Sources: New Constructs, LLC and company filings

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

* Best mutual funds exclude funds with NAV’s less than 100 million.

Sources: New Constructs, LLC and company filings

iShares Russell Top 200 Growth Index Fund [s: IWY] is my top-rated large-cap growth ETF and Massachusetts Investors Growth Stock Fund [s: MGTIX] is my top-rated large-cap growth mutual fund. Both earn my Attractive rating.

Columbia Large-Cap Growth Equity Strategy Fund [s: RWG] is my worst-rated large-cap growth ETF and earns my Neutral rating. Mutual Fund Series Trust: JAG Large Cap Growth Fund [s: JLGAX] is my worst-rated large-cap growth mutual fund and earns my Very Dangerous rating.

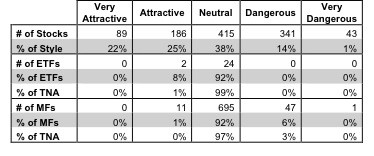

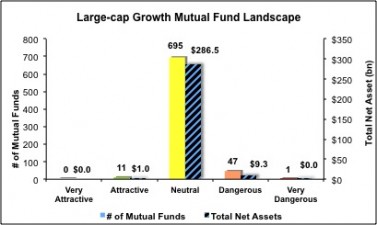

Figure 3 shows that 275 out of the 1074 stocks (over 47% of the total net assets) held by large-cap growth ETFs and mutual funds get an Attractive-or-better rating. However, only 2 out of 26 large-cap growth ETFs (less than 1% of total net assets) and 11 out of 754 large-cap growth mutual funds (less than 1% of total net assets) get an Attractive-or-better rating.

The takeaways are: mutual fund managers allocate too much capital to low-quality stocks and large-cap growth ETFs hold poor quality stocks.

Figure 3: Large-cap Growth Style Landscape For ETFs, Mutual Funds & Stocks

Investors need to tread carefully when considering large-cap growth ETFs and mutual funds, as 92% of ETFs and 98% of mutual funds are not worth buying. Only two large-cap growth ETFs and 11 large-cap growth mutual funds allocate enough value to Attractive-or-better-rated stocks to earn an Attractive rating.

Apple Inc. [s: AAPL] is one of my favorite stocks held by large-cap growth ETFs and mutual funds and earns my Very Attractive rating. AAPL has an impressive 270% return on invested capital (ROIC), and has kept its ROIC over 100% for the last 5 years. AAPL is still a great buy opportunity. People have speculated that Apple had reached its peak, but time and time again they continue to bring innovation to the market place. AAPL’s large amount of cash and high ROIC give it the freedom to internally fund the creation of new innovative products for many years into the future.

Electronic Arts, Inc. [s: EA] is one of my least favorite stocks held by large-cap growth ETFs and mutual funds and earns my Dangerous rating. EA has a five-year history of negative economic earnings, destroying value for its shareholders. EA’s current stock price of $14.87 implies the company will grow its revenues by 20% annually for 22 years. The company has not achieved 20% revenue growth in a single year, which suggests that 22 years of 20% revenue growth might mean the stock is overpriced.

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

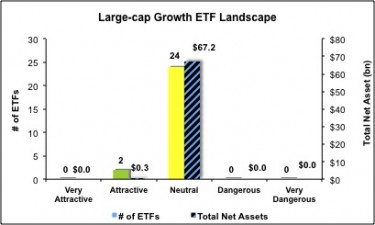

Figures 4 and 5 show the rating landscape of all large-cap growth ETFs and mutual funds.

Our style roadmap report ranks all styles and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst Funds

Figure 5: Separating the Best Mutual Funds From the Worst Funds

Review my full list of ratings and rankings along with free reports on all 26 ETFs and 754 mutual funds in the large-cap growth style.

Disclosure: I own AAPL. I receive no compensation to write about any specific stock, sector, style or theme.